Quarterly Business Update Q1 2024 Please see Legal Notices at the end of this report for explanation of Forward-Looking Statements and important cautions.

2 The last decade has led to a defining moment for our company, and industry at large: Luminar has officially begun production for the first global consumer vehicle that will include our LiDAR as standard equipment. Luminar's New Era is here. It begins with Volvo Cars and the launch of their new flagship vehicle, the EX90, which marks the first of over 25 commercial programs expected to follow. As a result, Luminar is planning to ship five times more LiDARs in the second half of this year than in the prior 10 years combined. At Luminar Day, we unveiled our next-generation LiDAR technology – Luminar Halo. It will enable up to 4x the performance, is 3x smaller, boasts 2x the efficiency, and offers a 2x cost improvement over Iris. While Iris is successfully converting our vision for safety into reality, beginning with high-end vehicles, Luminar Halo is designed for mainstream adoption. This is a crucial step forward toward realizing our vision of democratizing safety for all. While most autonomous vehicle companies face substantial regulatory headwinds, requiring government approvals for each geography to begin deployment of their technologies, Luminar enjoys the opposite effect with massive regulatory tailwinds. Last week, US regulators at NHTSA published a landmark new rule mandating advanced, higher- speed automatic emergency braking (AEB) for both vehicles and pedestrians, even at night. This applies to all new vehicles manufactured and sold by 2029. I'm proud to see US regulators taking such a big step towards requiring next-generation safety to be widespread, a decade in the making. Automotive safety regulations are prohibited from requiring named technologies, but rather establish rules and tests which they must enable. We believe long-range LiDAR is required to meet NHTSA’s new mandate, particularly with high-speed and night-time automated braking scenarios. Correspondingly, we believe the opportunity for adoption and standardization of our technology has increased by as much as an order of magnitude, and a decade earlier than expected. It's clear to me the broader autonomous vehicle industry sits today at the bottom of the "trough of disillusionment," moving towards the "slope of enlightenment." The question is which companies will lead the industry to that transition – and today, I think it's clear that includes Luminar. We've differentiated ourselves from the autonomous vehicle pack with our products and strategy to enhance (rather than replace) drivers, and now it's beginning to pay off. In a recent note on our restructuring, I explained how Luminar currently stands at the crossroads of two realities: the core of our business has never been stronger across technology, product, industrialization, and commercialization; yet at the same time the capital markets around our company have seen the inverse. We look forward to continuing to differentiate ourselves, while also disentangling perception of correlation with EV startups, fully autonomous vehicle companies, and other tech companies in our industry that couldn't make it work. Going through an end-to-end industrialization process to meet global automotive standards is incredibly grueling, and our most critical company-level objective was to ensure a successful SOP. We knew there was an opportunity to substantially reduce costs after this milestone, and historically communicated as such, leveraging our partners for greater operational efficiency. Last month, we announced an expanded partnership with TPK to provide us with significant resources for industrialization, which includes optimizing manufacturing design, automation, and supplier management. Correspondingly, we needed to reduce redundant roles in our company. We also took the opportunity to drive other cost savings actions, the first phase of which were performed on Friday. 2024 is the key inflection point for our company and the culmination of a decade of work. The Luminar team and I have never been more confident in the opportunity to realize the value of our business and our mission. We’ll see you on the road ahead. A Message from Founder & CEO Austin Russell Q1 2024 Quarterly Business Update

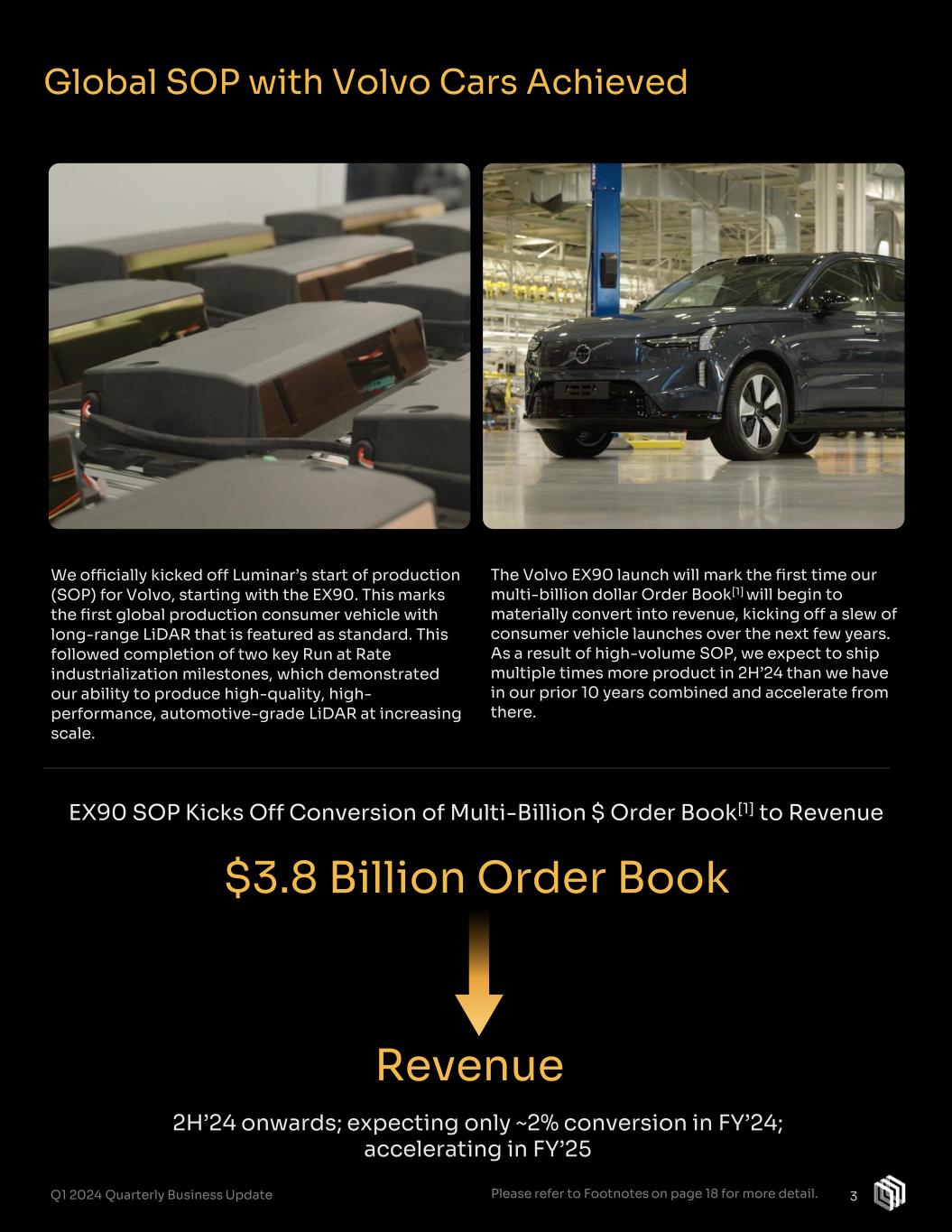

Global SOP with Volvo Cars Achieved EX90 SOP Kicks Off Conversion of Multi-Billion $ Order Book[1] to Revenue The Volvo EX90 launch will mark the first time our multi-billion dollar Order Book[1] will begin to materially convert into revenue, kicking off a slew of consumer vehicle launches over the next few years. As a result of high-volume SOP, we expect to ship multiple times more product in 2H’24 than we have in our prior 10 years combined and accelerate from there. We officially kicked off Luminar’s start of production (SOP) for Volvo, starting with the EX90. This marks the first global production consumer vehicle with long-range LiDAR that is featured as standard. This followed completion of two key Run at Rate industrialization milestones, which demonstrated our ability to produce high-quality, high- performance, automotive-grade LiDAR at increasing scale. $3.8 Billion Order Book Revenue 2H’24 onwards; expecting only ~2% conversion in FY’24; accelerating in FY’25 3Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

ICE Internal Combustion Engines HEV Hybrid Electric Vehicles EV Electric Vehicles Luminar is planned into 25+ commercial programs Luminar is powertrain agnostic Volvo EX90 kicks off a plethora of subsequent vehicle launches with Luminar Planned into programs across all major powertrains From First Launch To Mass Adoption 4Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

Riding the Tailwind from NHTSA’s Rulemaking While NHTSA regulations dictate performance rather than technologies, we think these rules will be difficult to achieve without LiDAR. And as we discussed at Luminar Day, while the broader autonomous vehicle industry faces regulatory headwinds, this is but one more tailwind for Luminar. NHTSA's findings are consistent with IIHS, AAA, and other agencies. Today’s camera/radar-based AEB systems are simply not good enough. We are not aware of any current system, besides our own, that can meet this new mandate with its higher speeds, night tests, 90mph forward collision warning, and false positive requirements. We see this mandate as a great opportunity and are looking forward to helping automakers achieve these new safety standards with advanced hardware and software, and ultimately save more lives. Luminar system outperforms them by a margin of nearly 27% on frequency reduction of vehicle accidents and nearly 40% on mitigation power performance. The 1st and 2nd best performers are 2022 model year vehicles of top European car brands, equipped with the latest and fullest set of camera- and radar- based technology available on the market. In May 2024, the National Highway Traffic Safety Administration (NHTSA) published the Final Rule adopting new Federal Motor Safety Standard No. 127, which mandates advanced higher-speed, no- contact Automatic Emergency Braking (AEB), including no-contact Pedestrian AEB (PAEB), systems on new cars and light trucks. All new vehicles must comply by 2029 with all requirements, with most requirements becoming mandated in 2028. Swiss Re’s safety efficacy study of our technology further demonstrates our system outperforms the best performing camera/radar-based vehicles in terms of accident reduction and severity mitigation. We believe camera/radar-based systems will continue to struggle, especially with: 1. Forward collision warning up to 90mph 2. AEB at higher speeds up to 62mph 3. No contact AEB, including PAEB, at night Shortly before the NHTSA mandate, Swiss Re released the results of its comprehensive vehicle safety testing intended to measure the efficacy of Luminar’s technology in preventing and reducing the severity of accidents. When compared to the overall 1st and 2nd best performers out of Swiss Re’s benchmark, the 100% of new vehicles in the US required to have advanced AEB/PAEB/FCW systems by 2029 5 Supported by Swiss Re Safety Study Results 27% Reduction in frequency of accidents 40% Reduction in severity of accidents that do happen Luminar compared to two best vehicles in Swiss Re’s benchmark: Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

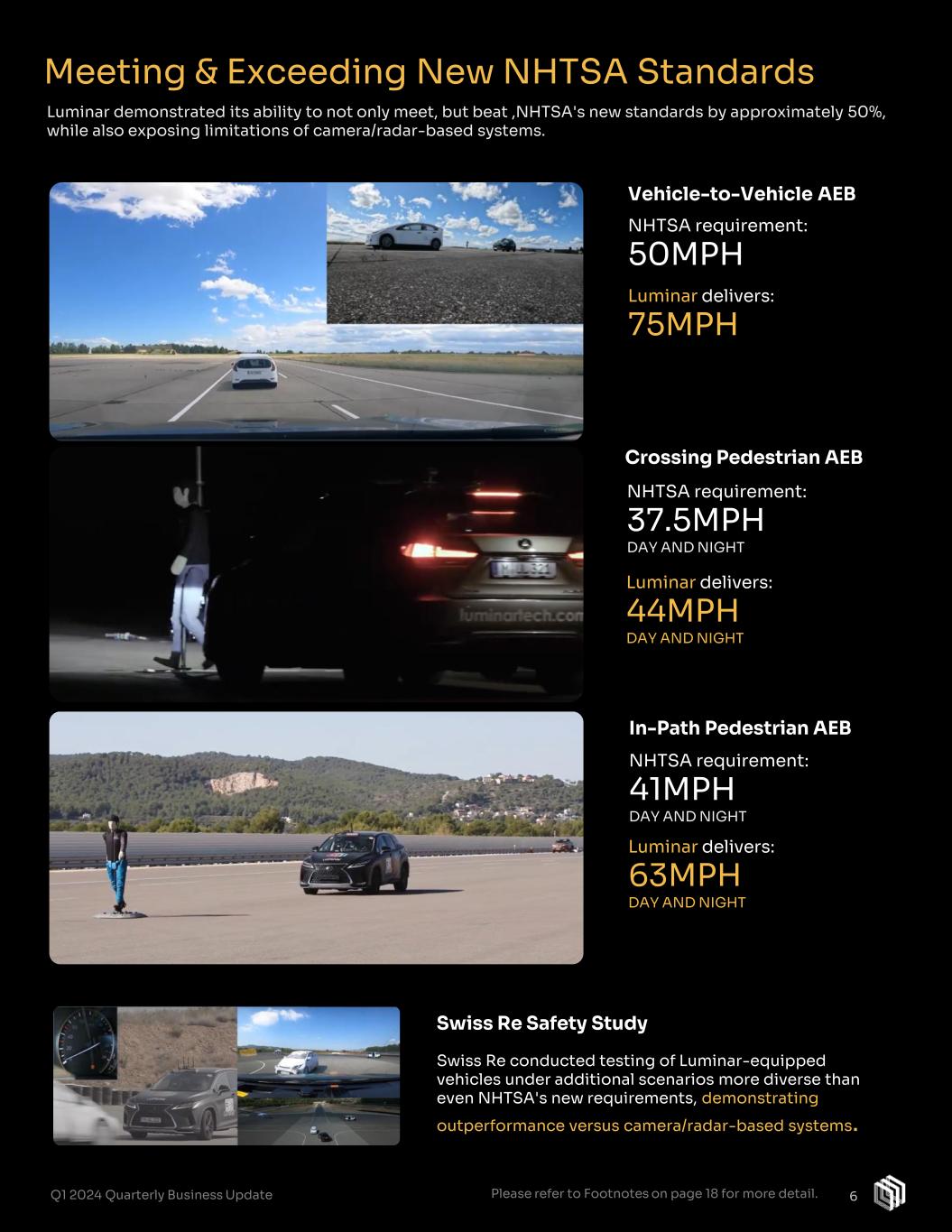

6 Luminar demonstrated its ability to not only meet, but beat ,NHTSA's new standards by approximately 50%, while also exposing limitations of camera/radar-based systems. Meeting & Exceeding New NHTSA Standards Swiss Re Safety Study Swiss Re conducted testing of Luminar-equipped vehicles under additional scenarios more diverse than even NHTSA's new requirements, demonstrating outperformance versus camera/radar-based systems. NHTSA requirement: 50MPH Luminar delivers: 75MPH Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update Vehicle-to-Vehicle AEB Crossing Pedestrian AEB NHTSA requirement: 37.5MPH DAY AND NIGHT Luminar delivers: 44MPH DAY AND NIGHT In-Path Pedestrian AEB NHTSA requirement: 41MPH DAY AND NIGHT Luminar delivers: 63MPH DAY AND NIGHT

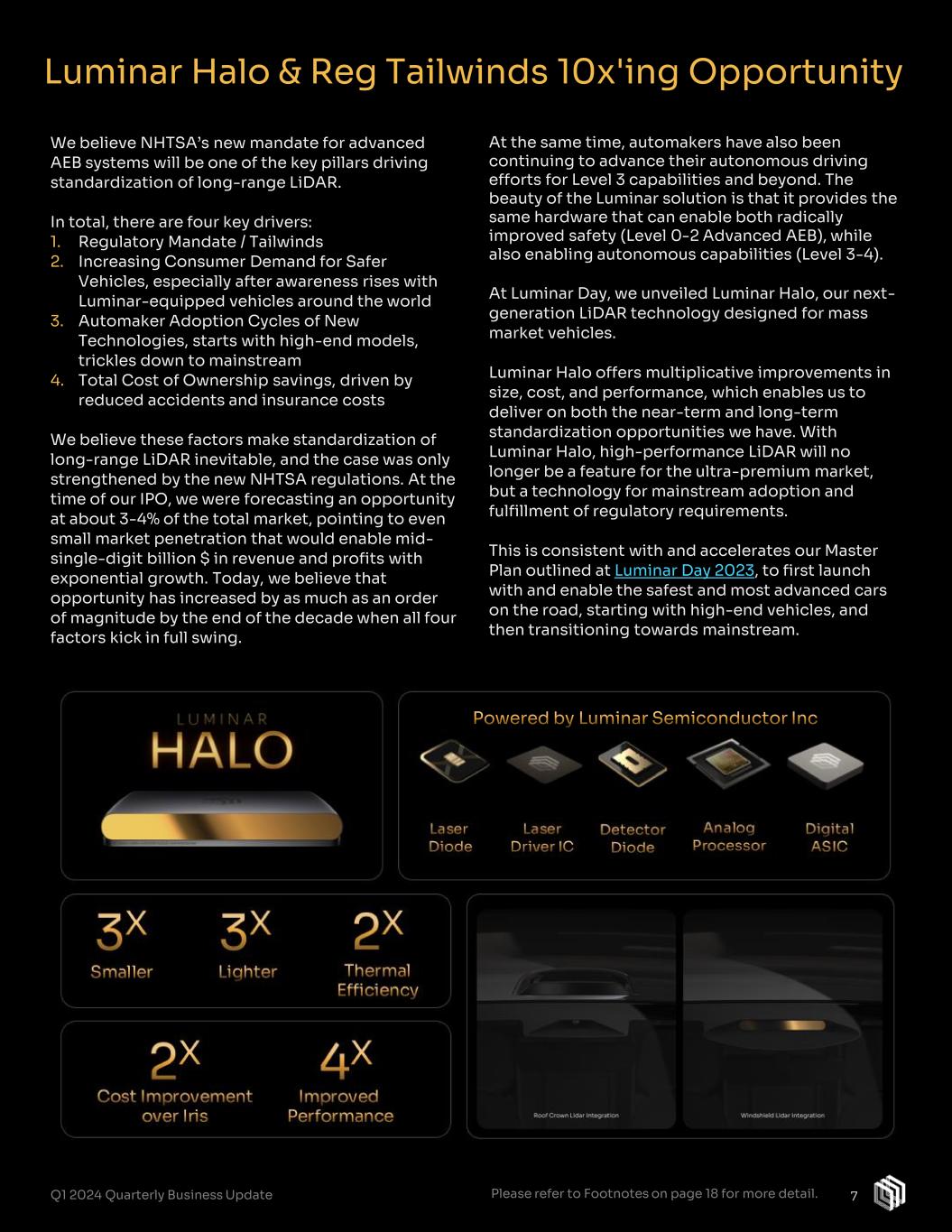

At the same time, automakers have also been continuing to advance their autonomous driving efforts for Level 3 capabilities and beyond. The beauty of the Luminar solution is that it provides the same hardware that can enable both radically improved safety (Level 0-2 Advanced AEB), while also enabling autonomous capabilities (Level 3-4). At Luminar Day, we unveiled Luminar Halo, our next- generation LiDAR technology designed for mass market vehicles. Luminar Halo offers multiplicative improvements in size, cost, and performance, which enables us to deliver on both the near-term and long-term standardization opportunities we have. With Luminar Halo, high-performance LiDAR will no longer be a feature for the ultra-premium market, but a technology for mainstream adoption and fulfillment of regulatory requirements. This is consistent with and accelerates our Master Plan outlined at Luminar Day 2023, to first launch with and enable the safest and most advanced cars on the road, starting with high-end vehicles, and then transitioning towards mainstream. We believe NHTSA’s new mandate for advanced AEB systems will be one of the key pillars driving standardization of long-range LiDAR. In total, there are four key drivers: 1. Regulatory Mandate / Tailwinds 2. Increasing Consumer Demand for Safer Vehicles, especially after awareness rises with Luminar-equipped vehicles around the world 3. Automaker Adoption Cycles of New Technologies, starts with high-end models, trickles down to mainstream 4. Total Cost of Ownership savings, driven by reduced accidents and insurance costs We believe these factors make standardization of long-range LiDAR inevitable, and the case was only strengthened by the new NHTSA regulations. At the time of our IPO, we were forecasting an opportunity at about 3-4% of the total market, pointing to even small market penetration that would enable mid- single-digit billion $ in revenue and profits with exponential growth. Today, we believe that opportunity has increased by as much as an order of magnitude by the end of the decade when all four factors kick in full swing. 7 Powered by Luminar Semiconductor Inc Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update Luminar Halo & Reg Tailwinds 10x'ing Opportunity

Advancing Our Industrialization with TPK focused on product, process, and supplier development to support Luminar. Examples of resources provided by TPK include: • Supplier development and management • Cost-downs and value engineering improvements • Automation process design and development • Process verification and validation • System validation The LTEC partnership structure allows Luminar to accelerate its time to market for future products and technologies, while working hand-in-hand with TPK from prototype to production. These LTEC activities are separate from and accretive to our contract manufacturing relationships with TPK, Fabrinet, and Celestica, which are continuing as planned. When we discuss industrialization, we are referring to the process of preparing for high volume industrial production and managing our supply base. At Luminar Day, we announced an expansion of our partnership with TPK, where they have committed to an exclusive relationship with Luminar, in which they are providing significant resources to improve the speed of industrialization for future products, reduce overhead costs internally at Luminar, and improve supply chain costs for current products as well. These supply chain cost improvements were not included in our restructuring savings calculations. Our expanded partnership with TPK – known as LTEC (Luminar TPK Industrialization Excellence Center) – includes dedicated full-time employees 8Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

9 9Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update When we founded Luminar over a decade ago, it was a formidable task to try to develop a technology, build a product, industrialize that product, get to a stage where we are delivering that product to automakers in a way that meets global production standards – let alone do all of that in high volume. Now that we’ve made the necessary billion-dollar R&D investments from the chip-level up and successfully launched with SOP as a standardized technology, the business model and cost structure that enabled us to achieve this leadership position no longer fit the needs of the company. As we communicated at Q4’23 Earnings, the highest priority for our organization was reaching start of production (SOP) with Volvo Cars, which we have now successfully achieved. We had planned cost reduction efforts shortly after Volvo SOP in order to streamline our operations, accelerate product development and industrialization, and speed up our path to profitability. In conjunction with this effort to better leverage our partners and focus more on our core competencies and highest priorities as a company, we recently announced the unfortunate reduction in our workforce by approximately 20%. This was a very difficult decision for our company. We have tremendous gratitude to our employees and regret the impact this has had on them. Beyond the restructuring actions outlined, we also have numerous other cost reduction actions underway to further drive our path to profitability. We estimate the result of these realignment actions for our company are annual savings of roughly $80M compared to our Q1 cost levels. Headcount - Cash Headcount - Stock Contractor Reduction Other Sources of ~$80M Annual Cost Savings Corporate Restructuring for the New Era The First Step This strategic realignment is a necessary step in the New Era for Luminar and is the first of additional actions to come that will ensure we can scale more efficiently, cost effectively, and quickly in the future. These efforts will put us on the right path towards profitability. For clarity around our strategy: What We are Doing • Expanding partnerships for third parties to take on costs otherwise required to be funded by Luminar • Reducing Luminar corporate headcount to eliminate redundancies and ensure a leaner structure • Rolling off most of our contractors • Accelerating speed of industrialization • Expanding footprint in low-cost countries, including India • Sub-leasing certain portions of facilities that are no longer required with our expanded TPK partnership What We are Not Doing • Reducing our global presence or manufacturing footprint • Outsourcing core value components of our hardware or AI software [2] to our partners • Reducing scope of our business or changing our revenue plan Highlights of Cost Savings Initiatives • ~$80M annual run-rate savings from all initiatives combined • ~$6M-$8M cash charges for employee severance & related employee costs, plus incremental charges related to acceleration of stock-based awards & grants of new awards

We ended Q1’24 with $268M in Cash & Liquidity[4]. This number excludes ~$7M of capital raised under our strategic equity financing program in late March, but did not settle until early April, to backfill a small cash acquisition we completed for our ATS segment in late March. As previewed at Q4’23 reporting, we recently filed a new universal mixed registration shelf, as well as renewed and expanded our strategic equity financing program to optimize future financial flexibility. These filings are not intended to signal an imminent large equity offering, but instead to give us the continued ability to issue, over time, shares to vendors in lieu of cash and for other purposes. Now that we have reached Volvo SOP and executed the first step of our broader restructuring and cost reduction strategy, we are finalizing our analysis of additional capital needs to reach profitability. We believe we have sufficient cash & liquidity to get us to at least the end of next year and continue to have access to multiple sources of additional capital required to address our future needs. Our future quarterly results remain highly dependent on the timing and cadence of Volvo Car’s production ramp and pace of our sensor production cost improvements. For this reason, we are continuing to limit our formal guidance to what we believe are the most important metrics for our company: Quarterly Revenue Run Rate by YE’24 and YE’24 Cash & Liquidity[4], both of which we are reiterating. Our Q1’24 financial results were generally consistent with the guidance provided at Q4’23 reporting. Specifically, Q1 Revenue declined slightly QoQ, while Gross Loss improved QoQ as our launch-related costs started to wind down. Now that we have successfully reached Volvo Cars SOP, we are shifting our top priority to cost cutting and efficiency improvements. As a first step, we announced last week a restructuring plan and other cost cutting initiatives, which in aggregate is expected to total $80M in annual run-rate savings. A little over half of these savings are expected in cash and the remainder in stock issued to employees and vendors. The next step in our cost reduction plan is to reduce our sensor production costs in addition to a continued roll-off of launch related costs. It will take a few quarters for our sensor production costs to substantially decline from our planned actions. As we transition from prototype production to series production, ASPs will be lower. Although our Gross Loss improved during Q1, we expect these lower ASPs to temporarily increase our Gross Loss over the next few quarters until we start to realize the benefits of our sensor production cost reduction actions, increase scale, and work out production “kinks”. Change in Cash, Cash Equivalents, and Marketable Securities (“Change in Cash” [3]) increased QoQ primarily due to a $21M working capital swing to support Volvo SOP. A Message from CFO Tom Fennimore 10Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

Q1 Revenue of $21.0M increased 45% YoY, but fell 5% QoQ. This was consistent with our guidance for Q1’24 revenue to be in line to slightly lower than Q4’23 ($22.1M). The lower QoQ revenue was mainly driven by lower sensor sales to non-automotive customers. This was offset by sensor sales to Tesla, which was our largest LiDAR customer in Q1 and comprised more than 10% of our revenue in the quarter. Q1’24 Gross loss was $(10.5)M on a GAAP basis and $(4.8)M on a non- GAAP[5] basis. This was a bit better than our guidance for Q1’24 Non- GAAP gross loss to improve slightly versus Q4’23 ($16.6M). This improvement was driven by lower launch-related costs. During Q1’24, our non-GAAP Gross Loss included $8M of launch-related expenses [6], a $10M improvement from Q4’23. Q1 experienced a QoQ decline in inventory reserves and write-downs as a result of on-going process improvements, lower losses on an Iris+ development contract as we reined in efforts and costs to complete the contract, and lower consultant costs to support launches. We still have work ahead to improve our Iris unit economics as we launch and ramp series production for Volvo Cars, for which our ASP is lower. Q1 GAAP Net loss was $(125.7)M or EPS of $(0.30), and Q1 non-GAAP[5] Net loss was $(80.5)M or EPS of $(0.19). Q1 GAAP Net loss included accelerated depreciation[7] for equipment expected to be abandoned due to certain outsourcing actions initiated during Q3 ’23, which was excluded from non-GAAP results. Q1’24 Change in Cash, Cash Equivalents, and Marketable Securities (“Change in Cash” [3]) QoQ was $(71.5)M. The QoQ decrease was consistent with our guidance for change in cash & liquidity to be greater in Q1’24 than Q4’23 as we built working capital to support Volvo SOP. We incurred an estimated $21M working capital headwind QoQ associated with our preparation for high volume production. Operating cash flow was $(81.2)M, and Free cash flow [8], measured as Operating cash flow less CapEx, was $(82.5)M. We ended Q1’24 with $268.3M in Cash & Liquidity[4], which includes both marketable securities and a $50M line of credit we executed in Q1’24 that has not been drawn upon. Our quarter-end cash balance excludes ~$7M of capital we raised in late March under our strategic equity financing program, but did not close until early April. This cash was primarily used to backfill a small cash acquisition we completed for our ATS segment in late March. Revenue Up 45% YoY & down 5% QoQ Consistent with guidance to be slightly lower versus Q4’23 Gross Loss Improved QoQ primarily due to launch-related cost wind down Better than guidance to slightly improve versus Q4’23 Net Loss & Loss per Share Improved QoQ on a GAAP and Non-GAAP[5] basis Change in Cash[3] $(72)M QoQ change Spend increased QoQ, primarily due to $21M working capital headwind with prep for SOP Cash & Liquidity[4] $268M at end of Q1’24, including $50M line of credit Q1 2024 Financial Summary 11Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

Reiterating FY’24 Financial Guidance 12 2024 Revenue Quarter Run Rate of Mid-$30M in 2H’24 Cash & Liquidity[4] >$150M at YE’24 Q2’24 Revenue Potentially Lower in Q2, Change in Cash[3] Improved We continue to expect to achieve a quarterly run rate of revenue in the mid- $30M range[9] reflecting the production ramp with Volvo in 2H’24. We expect strong growth in sensor sales and revenue in 2H’24 as we ramp production. We continue expect to end FY’24 with >$150M in Cash & Liquidity[4], including the $50M credit line obtained in Q1’24. We expect Q2’24 Revenue to potentially be lower versus Q1’24 as the current work-phase for two non-series production customer contracts was successfully completed recently and terms for the next phase are being finalized. Series production revenue for Volvo in Q2 is expected to be modest as they begin their ramp, and we will begin recording contra revenue for Volvo related to warrants issued in 2020[10]. We expect Q2’24 Change in Cash[3] to improve versus Q1’24, due to reduced working capital investment and early returns on our cost saving actions. We are reiterating our FY’24 financial guidance. As we continue to gain more visibility around the pace of the Volvo production ramp and the timing of sensor production cost reductions and launch-related cost roll-off, we plan to provide more detail around our financial guidance, likely in 2H’24. Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

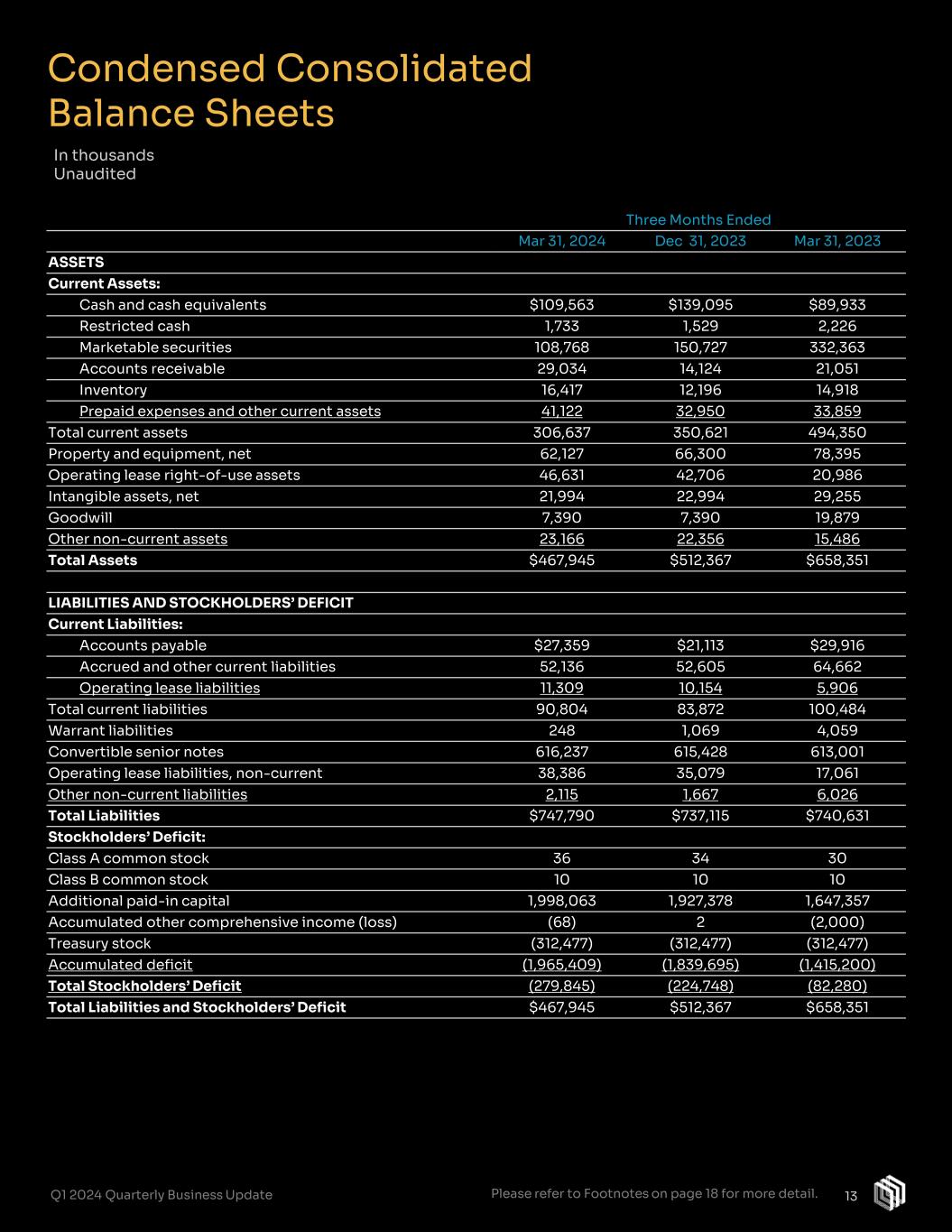

Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 ASSETS Current Assets: Cash and cash equivalents $109,563 $139,095 $89,933 Restricted cash 1,733 1,529 2,226 Marketable securities 108,768 150,727 332,363 Accounts receivable 29,034 14,124 21,051 Inventory 16,417 12,196 14,918 Prepaid expenses and other current assets 41,122 32,950 33,859 Total current assets 306,637 350,621 494,350 Property and equipment, net 62,127 66,300 78,395 Operating lease right-of-use assets 46,631 42,706 20,986 Intangible assets, net 21,994 22,994 29,255 Goodwill 7,390 7,390 19,879 Other non-current assets 23,166 22,356 15,486 Total Assets $467,945 $512,367 $658,351 LIABILITIES AND STOCKHOLDERS’ DEFICIT Current Liabilities: Accounts payable $27,359 $21,113 $29,916 Accrued and other current liabilities 52,136 52,605 64,662 Operating lease liabilities 11,309 10,154 5,906 Total current liabilities 90,804 83,872 100,484 Warrant liabilities 248 1,069 4,059 Convertible senior notes 616,237 615,428 613,001 Operating lease liabilities, non-current 38,386 35,079 17,061 Other non-current liabilities 2,115 1,667 6,026 Total Liabilities $747,790 $737,115 $740,631 Stockholders’ Deficit: Class A common stock 36 34 30 Class B common stock 10 10 10 Additional paid-in capital 1,998,063 1,927,378 1,647,357 Accumulated other comprehensive income (loss) (68) 2 (2,000) Treasury stock (312,477) (312,477) (312,477) Accumulated deficit (1,965,409) (1,839,695) (1,415,200) Total Stockholders’ Deficit (279,845) (224,748) (82,280) Total Liabilities and Stockholders’ Deficit $467,945 $512,367 $658,351 Condensed Consolidated Balance Sheets In thousands Unaudited 13Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

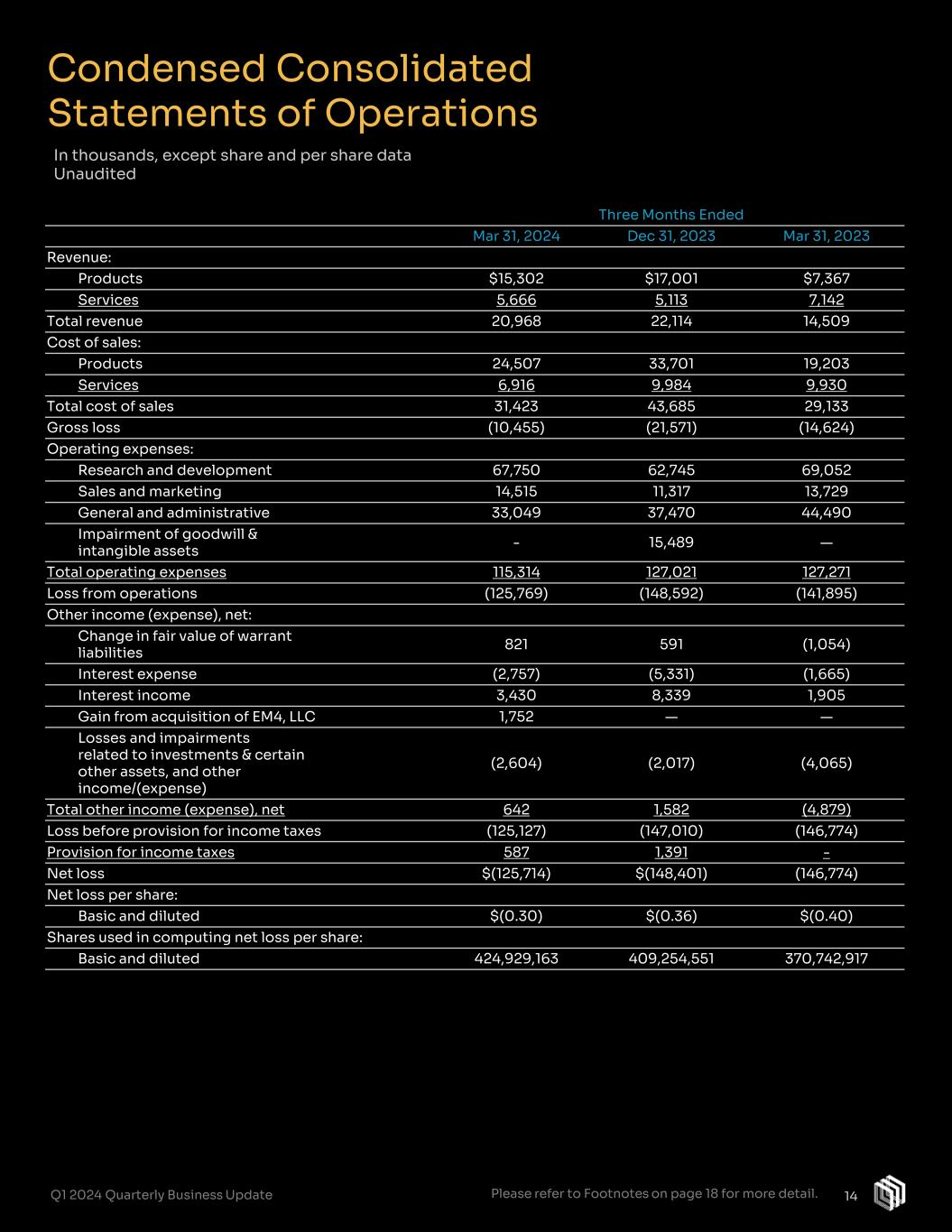

Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 Revenue: Products $15,302 $17,001 $7,367 Services 5,666 5,113 7,142 Total revenue 20,968 22,114 14,509 Cost of sales: Products 24,507 33,701 19,203 Services 6,916 9,984 9,930 Total cost of sales 31,423 43,685 29,133 Gross loss (10,455) (21,571) (14,624) Operating expenses: Research and development 67,750 62,745 69,052 Sales and marketing 14,515 11,317 13,729 General and administrative 33,049 37,470 44,490 Impairment of goodwill & intangible assets - 15,489 — Total operating expenses 115,314 127,021 127,271 Loss from operations (125,769) (148,592) (141,895) Other income (expense), net: Change in fair value of warrant liabilities 821 591 (1,054) Interest expense (2,757) (5,331) (1,665) Interest income 3,430 8,339 1,905 Gain from acquisition of EM4, LLC 1,752 — — Losses and impairments related to investments & certain other assets, and other income/(expense) (2,604) (2,017) (4,065) Total other income (expense), net 642 1,582 (4,879) Loss before provision for income taxes (125,127) (147,010) (146,774) Provision for income taxes 587 1,391 - Net loss $(125,714) $(148,401) (146,774) Net loss per share: Basic and diluted $(0.30) $(0.36) $(0.40) Shares used in computing net loss per share: Basic and diluted 424,929,163 409,254,551 370,742,917 Condensed Consolidated Statements of Operations In thousands, except share and per share data Unaudited 14Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

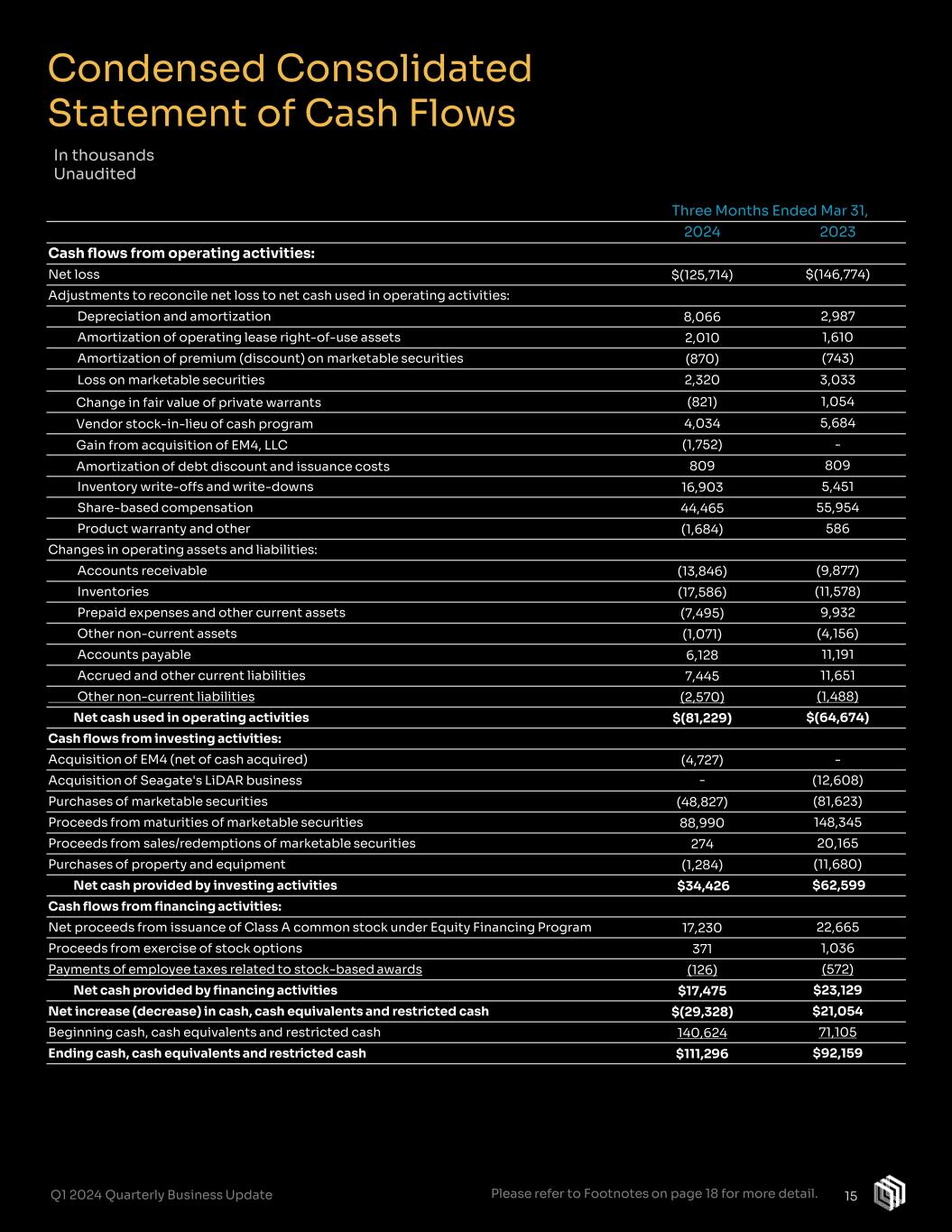

Three Months Ended Mar 31, 2024 2023 Cash flows from operating activities: Net loss $(125,714) $(146,774) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 8,066 2,987 Amortization of operating lease right-of-use assets 2,010 1,610 Amortization of premium (discount) on marketable securities (870) (743) Loss on marketable securities 2,320 3,033 Change in fair value of private warrants (821) 1,054 Vendor stock-in-lieu of cash program 4,034 5,684 Gain from acquisition of EM4, LLC (1,752) - Amortization of debt discount and issuance costs 809 809 Inventory write-offs and write-downs 16,903 5,451 Share-based compensation 44,465 55,954 Product warranty and other (1,684) 586 Changes in operating assets and liabilities: Accounts receivable (13,846) (9,877) Inventories (17,586) (11,578) Prepaid expenses and other current assets (7,495) 9,932 Other non-current assets (1,071) (4,156) Accounts payable 6,128 11,191 Accrued and other current liabilities 7,445 11,651 Other non-current liabilities (2,570) (1,488) Net cash used in operating activities $(81,229) $(64,674) Cash flows from investing activities: Acquisition of EM4 (net of cash acquired) (4,727) - Acquisition of Seagate's LiDAR business - (12,608) Purchases of marketable securities (48,827) (81,623) Proceeds from maturities of marketable securities 88,990 148,345 Proceeds from sales/redemptions of marketable securities 274 20,165 Purchases of property and equipment (1,284) (11,680) Net cash provided by investing activities $34,426 $62,599 Cash flows from financing activities: Net proceeds from issuance of Class A common stock under Equity Financing Program 17,230 22,665 Proceeds from exercise of stock options 371 1,036 Payments of employee taxes related to stock-based awards (126) (572) Net cash provided by financing activities $17,475 $23,129 Net increase (decrease) in cash, cash equivalents and restricted cash $(29,328) $21,054 Beginning cash, cash equivalents and restricted cash 140,624 71,105 Ending cash, cash equivalents and restricted cash $111,296 $92,159 Condensed Consolidated Statement of Cash Flows In thousands Unaudited 15Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

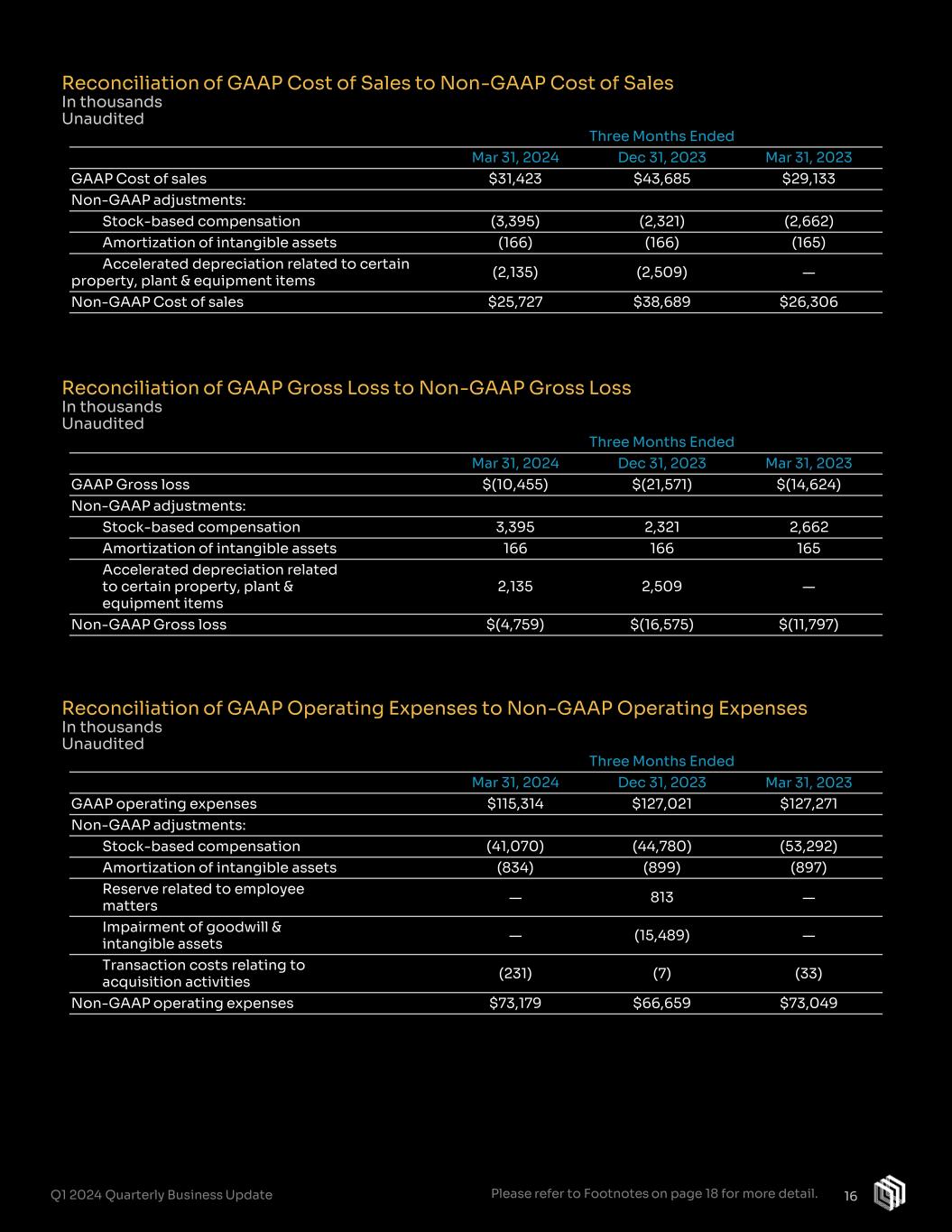

Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 GAAP Gross loss $(10,455) $(21,571) $(14,624) Non-GAAP adjustments: Stock-based compensation 3,395 2,321 2,662 Amortization of intangible assets 166 166 165 Accelerated depreciation related to certain property, plant & equipment items 2,135 2,509 — Non-GAAP Gross loss $(4,759) $(16,575) $(11,797) Reconciliation of GAAP Cost of Sales to Non-GAAP Cost of Sales In thousands Unaudited Reconciliation of GAAP Gross Loss to Non-GAAP Gross Loss In thousands Unaudited Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 GAAP operating expenses $115,314 $127,021 $127,271 Non-GAAP adjustments: Stock-based compensation (41,070) (44,780) (53,292) Amortization of intangible assets (834) (899) (897) Reserve related to employee matters — 813 — Impairment of goodwill & intangible assets — (15,489) — Transaction costs relating to acquisition activities (231) (7) (33) Non-GAAP operating expenses $73,179 $66,659 $73,049 Reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses In thousands Unaudited Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 GAAP Cost of sales $31,423 $43,685 $29,133 Non-GAAP adjustments: Stock-based compensation (3,395) (2,321) (2,662) Amortization of intangible assets (166) (166) (165) Accelerated depreciation related to certain property, plant & equipment items (2,135) (2,509) — Non-GAAP Cost of sales $25,727 $38,689 $26,306 16Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

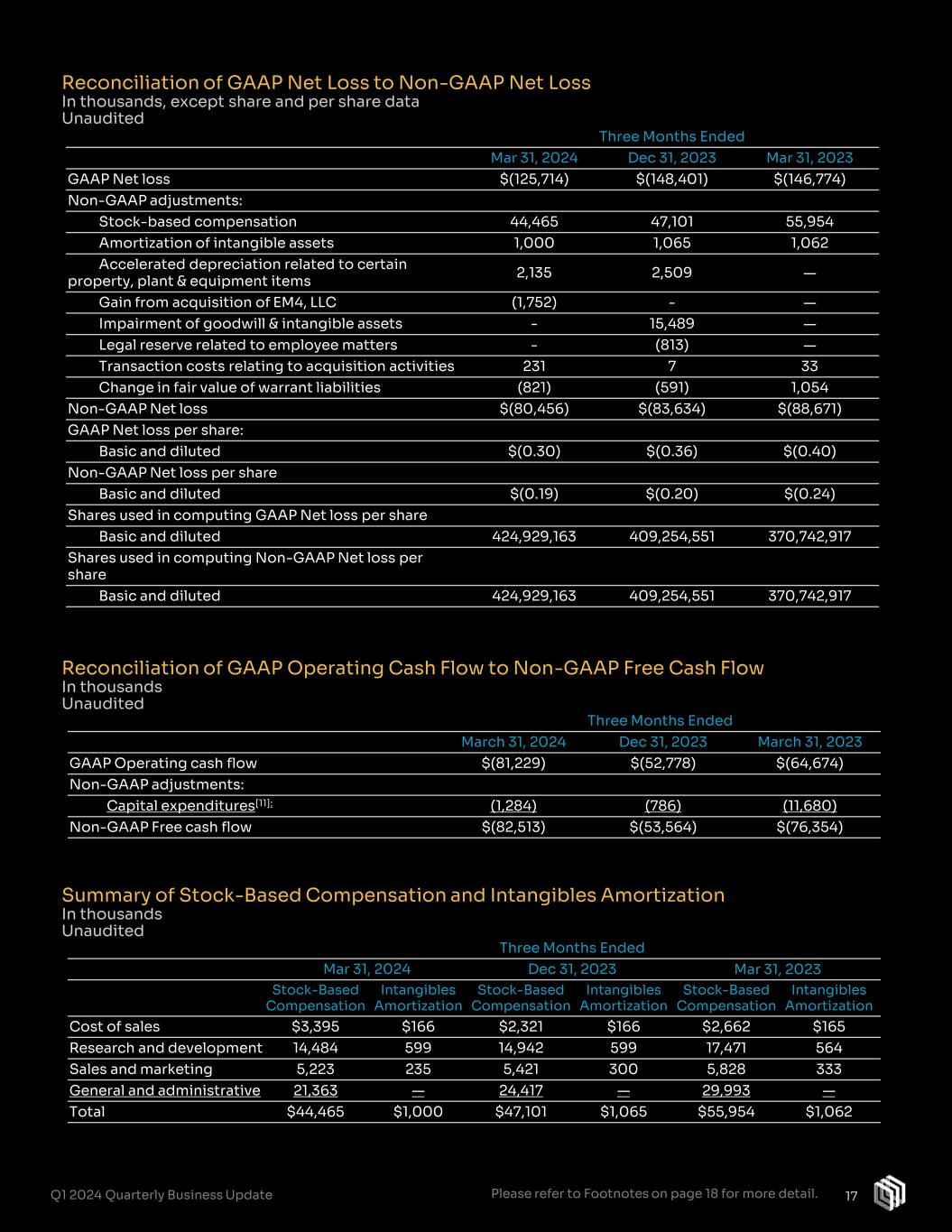

Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 GAAP Net loss $(125,714) $(148,401) $(146,774) Non-GAAP adjustments: Stock-based compensation 44,465 47,101 55,954 Amortization of intangible assets 1,000 1,065 1,062 Accelerated depreciation related to certain property, plant & equipment items 2,135 2,509 — Gain from acquisition of EM4, LLC (1,752) - — Impairment of goodwill & intangible assets - 15,489 — Legal reserve related to employee matters - (813) — Transaction costs relating to acquisition activities 231 7 33 Change in fair value of warrant liabilities (821) (591) 1,054 Non-GAAP Net loss $(80,456) $(83,634) $(88,671) GAAP Net loss per share: Basic and diluted $(0.30) $(0.36) $(0.40) Non-GAAP Net loss per share Basic and diluted $(0.19) $(0.20) $(0.24) Shares used in computing GAAP Net loss per share Basic and diluted 424,929,163 409,254,551 370,742,917 Shares used in computing Non-GAAP Net loss per share Basic and diluted 424,929,163 409,254,551 370,742,917 Reconciliation of GAAP Net Loss to Non-GAAP Net Loss In thousands, except share and per share data Unaudited 17 Reconciliation of GAAP Operating Cash Flow to Non-GAAP Free Cash Flow In thousands Unaudited Summary of Stock-Based Compensation and Intangibles Amortization In thousands Unaudited Three Months Ended March 31, 2024 Dec 31, 2023 March 31, 2023 GAAP Operating cash flow $(81,229) $(52,778) $(64,674) Non-GAAP adjustments: Capital expenditures[11]: (1,284) (786) (11,680) Non-GAAP Free cash flow $(82,513) $(53,564) $(76,354) Three Months Ended Mar 31, 2024 Dec 31, 2023 Mar 31, 2023 Stock-Based Compensation Intangibles Amortization Stock-Based Compensation Intangibles Amortization Stock-Based Compensation Intangibles Amortization Cost of sales $3,395 $166 $2,321 $166 $2,662 $165 Research and development 14,484 599 14,942 599 17,471 564 Sales and marketing 5,223 235 5,421 300 5,828 333 General and administrative 21,363 — 24,417 — 29,993 — Total $44,465 $1,000 $47,101 $1,065 $55,954 $1,062 Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

Footnotes & Legal Notices Footnotes 1 Order Book: Please refer to Order Book definition in Legal Notices on page 19, and within “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for more detail. 2 Software: Various Luminar software capabilities are still in development and have not achieved “technological feasibility” or “production ready” status. 3 Change in Cash: Change in Cash definition refers to change in cash, cash equivalents, and marketable securities, and excludes incremental liquidity from undrawn line of credit. 4 Cash & Liquidity: Cash definition includes Cash, cash equivalents, and marketable securities, but includes applicable lines of credit and other facilities. 5 Non-GAAP metrics: Please refer to Reconciliation of GAAP to Non-GAAP financial measures on pages 16-17. 6 Launch-related expenses: Luminar is incurring items such as charges for contractors to support testing and validation of manufacturing processes and product quality, rental of certain equipment to support manufacturing operations pending stabilization of utilities, under-absorption of fixed costs due to low volumes being produced, write-offs and claims from sub-contractors related to inventory obsoleted due to product design changes, etc. These charges are collectively being referred to as “launch costs”. These charges are expected to decline as we successfully industrialize our products. 7 Accelerated depreciation: Accelerated depreciation recorded in Q1’24 is excluded from non-GAAP results and is a non-cash charge. 8 Free Cash Flow: Free cash flow is a non-GAAP measure and is defined as Operating cash flow less Capital expenditures. 9 Revenue guidance: FY’24 quarterly run rate revenue guidance excludes the impact of amortization of warrants previously issued to Volvo which will be recognized on series production units sold during 2024. 10 Warrants: Luminar granted warrants to Volvo in March 2020 with vest to occur upon manufacturing and sale of a specified number of initial series production units. Amortization of these warrants will be recorded as a reduction to revenue through 2024. 11 Capital expenditures: Excludes Vendor stock-in-lieu of cash program - purchases and advances for capital projects and equipment of $1.1M of Q4’23 and $2.5M in Q1’23. Forward-looking statements This presentation of Luminar Technologies, Inc. (“Luminar” or the “Company”) includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private securities litigation reform act of 1995. Forward-looking statements may be identified by the use of words such as “future,” “growth,” “opportunity,” “well-positioned,” "forecast," "intend," "seek," "target," “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, all statements under "Reiterating FY'24 Financial Guidance," the Company’s growth trajectory and path to profitability, expected volume of LiDAR shipments, manufacturing scale up, industrialization cost trends, OEM production readiness, next-gen LiDAR development and capabilities, insurance cost savings opportunities, improvements in operational and financial efficiency including through restructuring and outsourcing, continued software and AI development, program milestones, impact that regulations will have on future adoption of technology, Order Book growth and conversion to revenue, future stock price, and other expected financial and business milestones. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of Luminar’s management and are not guarantees of actual performance. You are cautioned not to place undue reliance upon any forward-looking statements, including the projections, which speak only as of the date made. Luminar does not undertake any commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on the company’s current expectations and beliefs concerning future developments and their potential effects on Luminar. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements, including the risks discussed in the “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Luminar’s most recently filed periodic reports on Form 10-K and Form 10-Q, and other documents Luminar files with the SEC. Should one or more of these risks or uncertainties materialize, or should any of management’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Luminar does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, you should not put undue reliance on these statements. Trademarks and trade names Luminar owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended in, and does not imply, a relationship with Luminar, or an endorsement or sponsorship by or of Luminar. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Luminar will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor in these trademarks, service marks and trade names. 18Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update

Legal Notices Industry and market data In this presentation, Luminar relies on and refers to information and statistics regarding the sectors in which Luminar competes and other industry data. Luminar obtained this information and statistics from third-party sources, including reports by market research firms. Although Luminar believes these sources are reliable, the company has not independently verified the information and does not guarantee its accuracy and completeness. Luminar has supplemented this information where necessary with information from discussions with Luminar customers and Luminar’s own internal estimates, taking into account publicly available information about other industry participants and Luminar’s management’s best view as to information that is not publicly available. Use of non-GAAP financial measures In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this presentation contains certain non-GAAP financial measures and certain other metrics. Non-GAAP financial measures and these other metrics do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures and metrics presented by other companies. Luminar considers these non-GAAP financial measures and metrics to be important because they provide useful measures of the operating performance of the Company, exclusive of factors that do not directly affect what we consider to be our core operating performance, as well as unusual events. The Company’s management uses these measures and metrics to (i) illustrate underlying trends in the Company’s business that could otherwise be masked by the effect of income or expenses that are excluded from non-GAAP measures, and (ii) establish budgets and operational goals for managing the Company’s business and evaluating its performance. In addition, investors often use similar measures to evaluate the operating performance of a company. Non- GAAP financial measures and metrics are presented only as supplemental information for purposes of understanding the Company’s operating results. The non-GAAP financial measures and metrics should not be considered a substitute for financial information presented in accordance with GAAP. This presentation includes non-GAAP financial measures, including non-GAAP cost of sales, gross loss/gross profit, net loss and Free Cash Flow. Non-GAAP cost of sales is defined as GAAP cost of sales adjusted for stock-based compensation expense, amortization of intangible assets, and accelerated depreciation related to certain property, plant and equipment items. Non-GAAP gross loss/gross profit is defined as GAAP gross loss/gross profit adjusted for stock-based compensation expense, amortization of intangible assets, and accelerated depreciation related to certain property, plant and equipment items. Non-GAAP net loss is defined as GAAP net loss adjusted for stock-based compensation expense, amortization of intangible assets, accelerated depreciation related to certain property, plant and equipment items, legal reserve related to employee matters, transaction costs relating to acquisition activities, change in fair value of warrant liabilities, and provision for income taxes. Free Cash Flow is defined as operating cash flow less capital expenditures. We use “Order Book” as a metric to measure performance against anticipated achievement of planned key milestones of our business. Order Book is defined as the forward-looking cumulative billings estimate of Luminar’s hardware and software products over the lifetime of given vehicle production programs which Luminar’s technology is expected to be integrated into or provided for, based primarily on projected / actual contractual pricing terms and our good faith estimates of “take rate” of Luminar’s technology on vehicles. “Take rates” are the anticipated percentage of new vehicles to be equipped with Luminar’s technology based on a combination of original equipment manufacturer (“OEM”) product offering decisions and predicted end consumer purchasing decisions. For programs where we are standard, we assume a 100% take rate, while for programs where we are optional we assume a flat 25%. We include programs in our Order Book when (a) we have obtained a written or verbal agreement (e.g., non-binding expression of interest arrangement or an agreement for non-recurring engineering project), other reasonable expression of commitment, or public announcement with a major industry player, and (b) we expect to ultimately be awarded a significant commercial program. We believe Order Book provides useful information to investors as a supplemental performance metric as our products are currently in a pre-production stage and therefore there are currently no billings or revenues from commercial grade product sales. OEMs customarily place non-cancelable purchase orders with their automotive component suppliers only shortly before or during production. Consequently, we use Order Book to inform investors about the progress of expected adoption of our technologies by OEMs because there is, in our view, no other better metric available at our stage. The Order Book estimate may be impacted by various factors, as described in “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the most recent fiscal year and subsequent filings with the Securities and Exchange Commission, including, but not limited to the following: (i) None of our customers make contractual commitments to use our lidar sensors and software until all test and validation activities have been completed, they have finalized plans for integrating our systems, have a positive expectation of the market demand for our features, and unrelated to us, have determined that their vehicle is ready for market and there is appropriate consumer demand. Consequently, there is no assurance or guarantee that any of our customers, including any programs which we included in our Order Book estimates will ever complete such testing and validation or enter into a definitive volume production agreement with us or that we will receive any billings or revenues forecasted in connection with such programs; (ii) The development cycles of our products with new customers vary widely depending on the application, market, customer and the complexity of the product. In the automotive market, for example, this development cycle can be as long as seven or more years. Variability in development cycles make it difficult to reliably estimate the pricing, volume or timing of purchases of our products by our customers; (iii) Customers cancel or postpone implementation of our technology; (iv) We may not be able to integrate our technology successfully into a larger system with other sensing modalities; and (v) The product or vehicle model that is expected to include our lidar products may be unsuccessful, including for reasons unrelated to our technology. These risks and uncertainties may cause our future actual sales to be materially different than that implied by the Order Book metric. 19Please refer to Footnotes on page 18 for more detail. Q1 2024 Quarterly Business Update