UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 24, 2020

GORES METROPOULOS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38791 |

|

83-1804317 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 9800 Wilshire Blvd.

Beverly Hills, CA |

|

|

|

90212 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

(310) 209-3010

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☒ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange

on which registered |

| Class A Common Stock |

|

GMHI |

|

Nasdaq Capital Market |

| Warrants |

|

GMHIW |

|

Nasdaq Capital Market |

| Units |

|

GMHIU |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

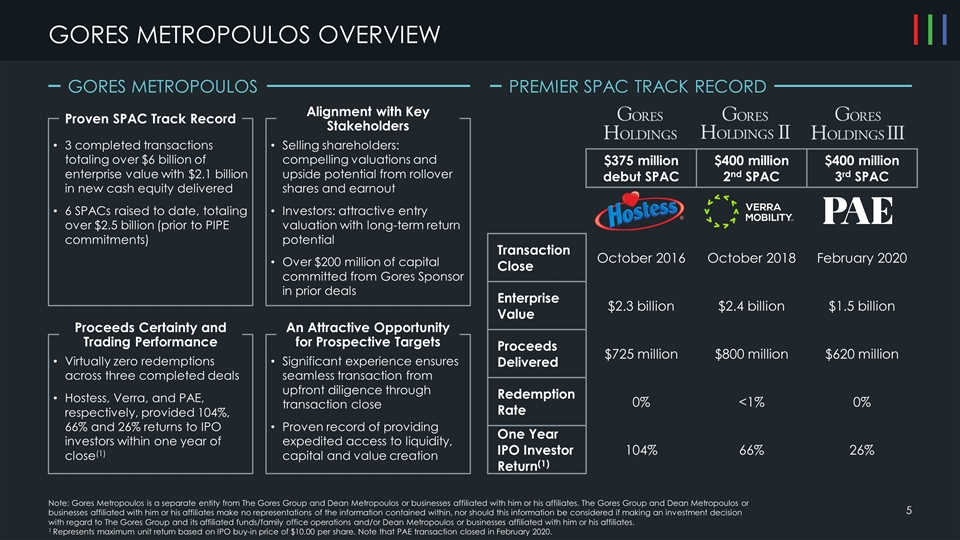

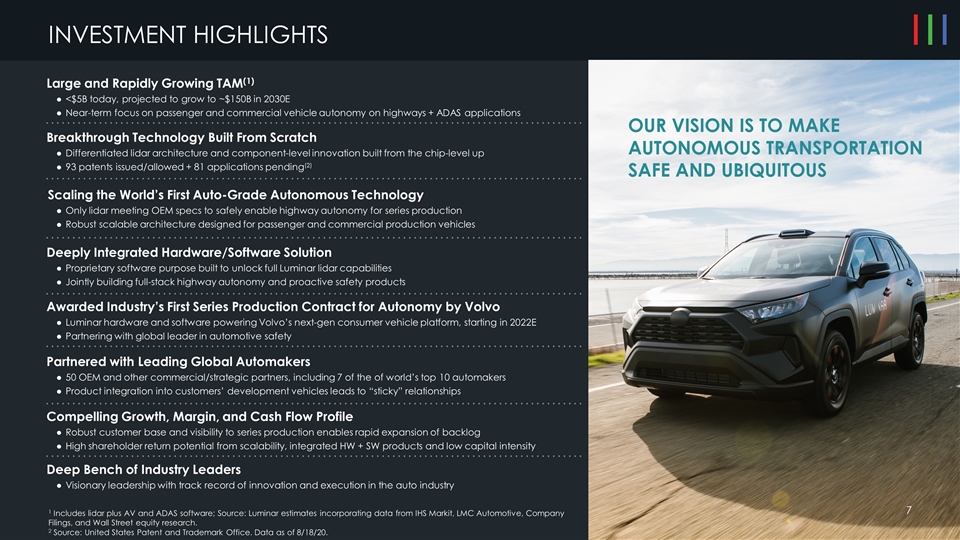

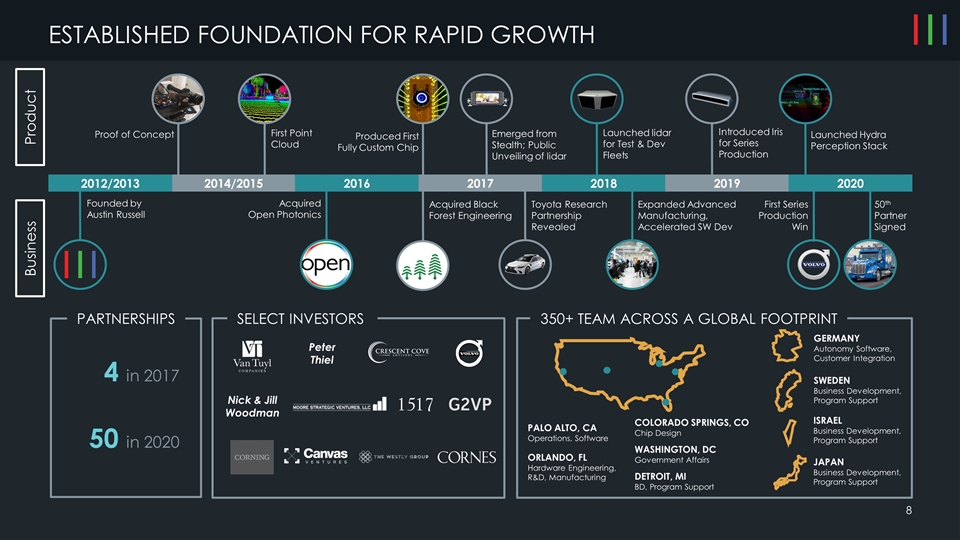

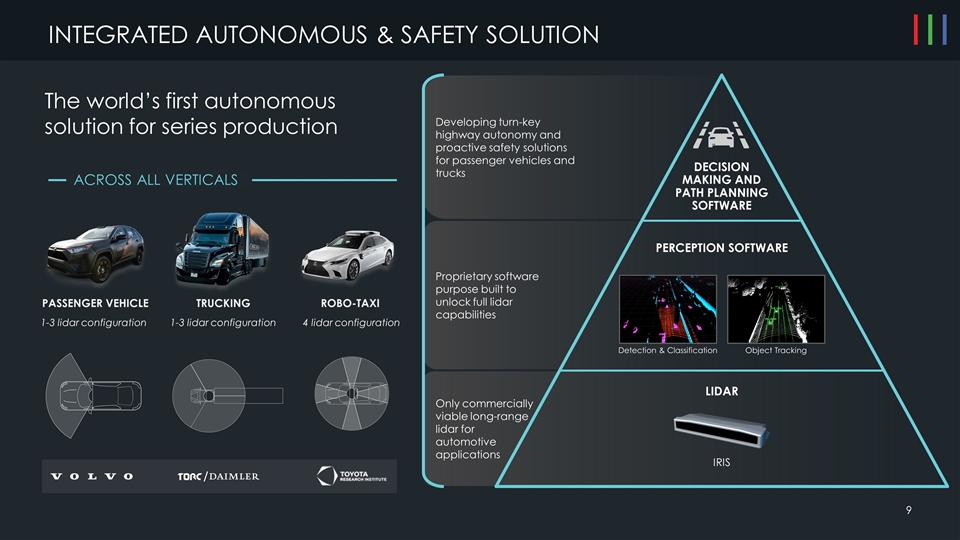

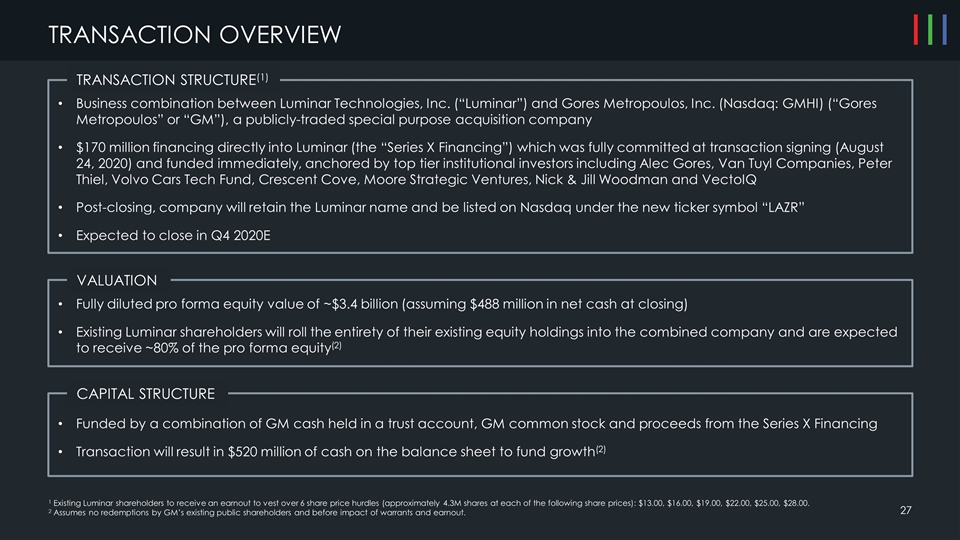

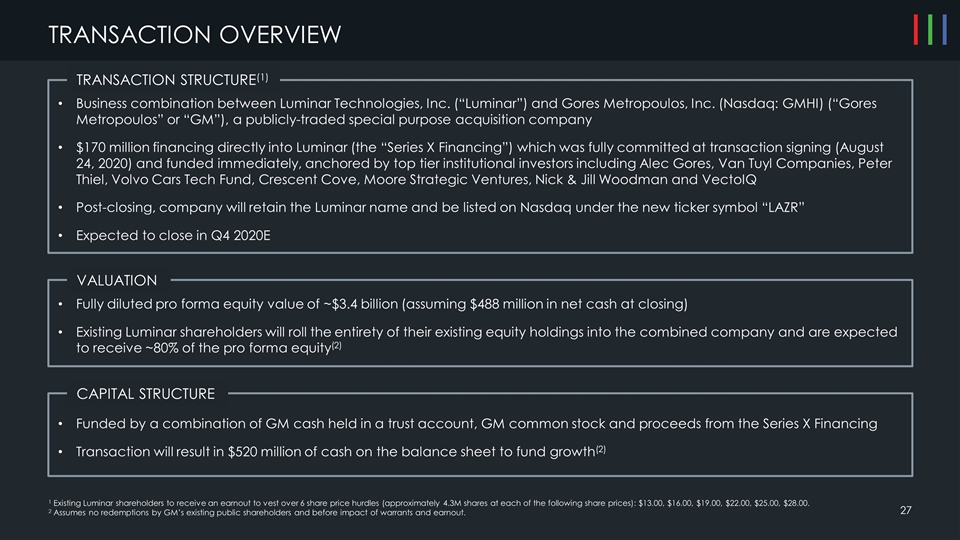

On August 24, 2020, Gores Metropoulos, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the

“Merger Agreement”), by and among the Company, Dawn Merger Sub, Inc. (“First Merger Sub”), Dawn Merger Sub II, LLC (“Second Merger Sub”) and Luminar Technologies, Inc. (“Luminar”),

which provides for, among other things: (a) the merger of First Merger Sub with and into Luminar, with Luminar continuing as the surviving corporation (the “First Merger”); and (b) immediately following the First Merger

and as part of the same overall transaction as the First Merger, the merger of Luminar with and into Second Merger Sub, with Second Merger Sub continuing as the surviving entity (the “Second Merger” and, together with the First

Merger, the “Mergers”). The transactions set forth in the Merger Agreement, including the Mergers, will constitute a “Business Combination” as contemplated by the Company’s Amended and Restated Certificate of

Incorporation.

The Merger Agreement and the transactions contemplated thereby were unanimously approved by the Board of Directors of the

Company (the “Board”) on August 23, 2020.

The Merger Agreement

Merger Consideration

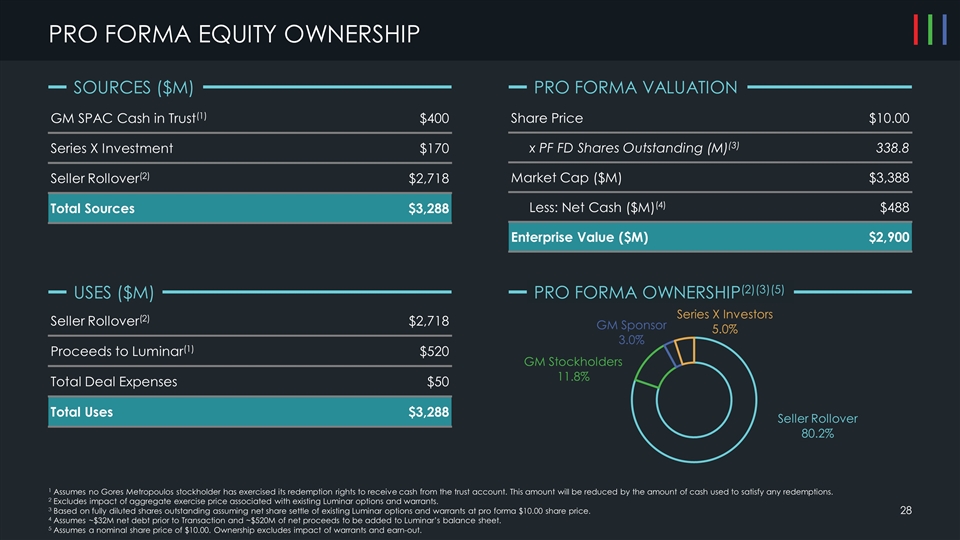

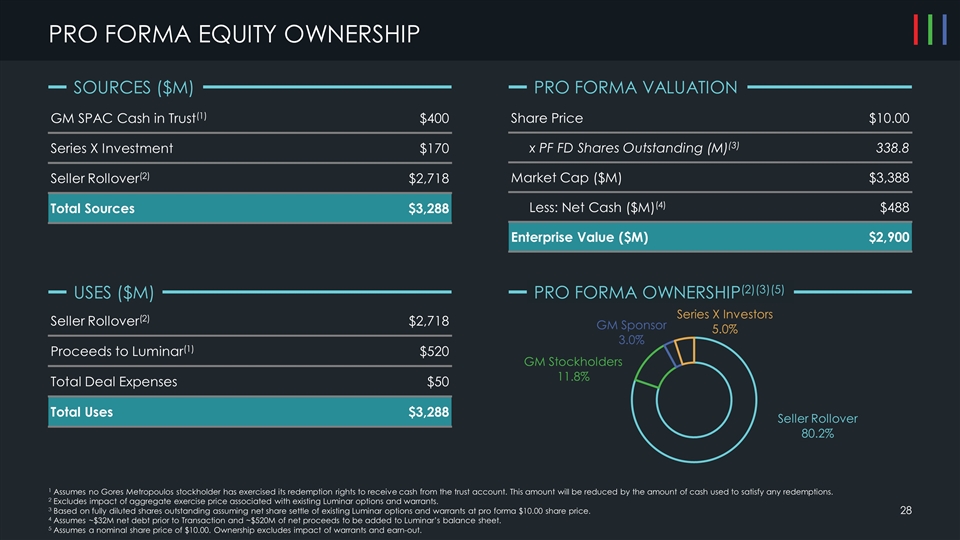

Pursuant to the

Merger Agreement, the aggregate merger consideration payable to the stockholders of Luminar will be a number of shares of Company common stock (deemed to have a value of $10.00 per share) with an implied value equal to $2,928,828,692, plus an

aggregate amount of up to $30,000,000 depending on the amount of additional capital raised by Luminar prior to the closing of the Business Combination, divided by $10.00. Holders of shares of (a) Luminar’s Class A common stock,

preferred stock and founders preferred stock will be entitled to receive a number of shares of newly-issued Company Class A common stock equal to the Per Share Company Stock Consideration (as defined in the Merger Agreement) issuable in Company

Class A common stock and (b) Luminar’s Class B common stock will be entitled to receive a number of shares of newly-issued Company Class B common stock equal to the Per Share Company Stock Consideration issuable in Company

Class B common stock.

In addition to the consideration to be paid at the closing of the Business Combination, stockholders of

Luminar will be entitled to receive an additional number of earn-out shares from the Company, issuable in either Company Class A common stock or Company Class B common stock as provided in the Merger

Agreement, of up to 7.5% of the total outstanding capital stock of the Company as of the closing of the Business Combination (including shares subject to outstanding Luminar stock options, restricted stock and warrants that will be assumed by the

Company in connection with the Business Combination).

Treatment of Luminar’s Equity Awards and Warrants

Pursuant to the Merger Agreement, at the closing of the Business Combination, each of Luminar’s stock options, to the extent then

outstanding and unexercised, will automatically be converted into an option to acquire shares of Company Class A common stock (determined by multiplying the number of shares of Luminar Class A common stock subject to such Luminar stock

option by the Per Share Company Stock Consideration), at an adjusted exercise price per share. Each such converted option will be subject to the same terms and conditions as were applicable immediately prior to such conversion. Each share of

Luminar’s restricted stock, to the extent then unvested and outstanding, will automatically be converted into shares of Company Class A common stock (determined by multiplying the number of shares of Luminar restricted stock subject to

such award by the Per Share Company Stock Consideration). Each such converted share of restricted stock will be subject to the same terms and conditions as were applicable immediately prior to such conversion.

Pursuant to the Merger Agreement, at the closing of the Business Combination, Luminar warrants, to the extent then outstanding and

unexercised, will automatically be converted into a warrant to acquire shares of Company Class A common stock (determined by multiplying the number of shares of Luminar Class A common stock subject to such Luminar warrant by the Per Share

Company Stock Consideration). Each such converted warrant will be subject to the same terms and conditions as were applicable immediately prior to conversion.

Representations, Warranties and Covenants

The parties to the Merger Agreement have made representations, warranties and covenants that are customary for transactions of this nature. The

representations and warranties of the respective parties to the Merger Agreement will not survive the closing of the transaction. The covenants of the respective parties to the Merger Agreement will also not survive the closing of the transaction,

except for those covenants that by their terms expressly apply in whole or in part after the closing of the transaction.

Conditions to Consummation of the Transaction

Consummation of the transactions contemplated by the Merger Agreement is subject to customary closing conditions, including approval by the

Company’s stockholders, approval by Luminar’s stockholders and the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Termination

The Merger Agreement may be

terminated at any time prior to the consummation of the Mergers (whether before or after each of the required Company stockholder vote and Luminar stockholder vote has been obtained) by mutual written consent of the Company and Luminar and in

certain other circumstances, including if the transactions have not been consummated by February 5, 2021 and the delay in closing beyond such date is not due to the breach of the Merger Agreement by the party seeking to terminate.

The foregoing description of the Merger Agreement and the transactions contemplated thereby, including the Mergers, does not purport to be

complete and is qualified in its entirety by the terms and conditions of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Merger Agreement contains representations, warranties

and covenants that the respective parties made to each other as of the date of such agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the

respective parties to the Merger Agreement and are subject to important qualifications and limitations agreed to by the contracting parties in connection with negotiating the Merger Agreement. The Merger Agreement has been attached to provide

investors with information regarding its terms. It is not intended to provide any other factual information about the Company or any other party to the Merger Agreement. In particular, the representations, warranties, covenants and agreements

contained in the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specific dates, were solely for the benefit of the respective parties to the Merger Agreement, may be subject to limitations agreed upon by the

contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the respective parties to the Merger Agreement instead of establishing these matters as facts) and may be subject

to standards of materiality applicable to the contracting parties that differ from those applicable to the Company’s investors and security holders. Company investors and security holders are not third-party beneficiaries under the Merger

Agreement and should not rely on the representations, warranties or covenants of any party to the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger

Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Support Agreement

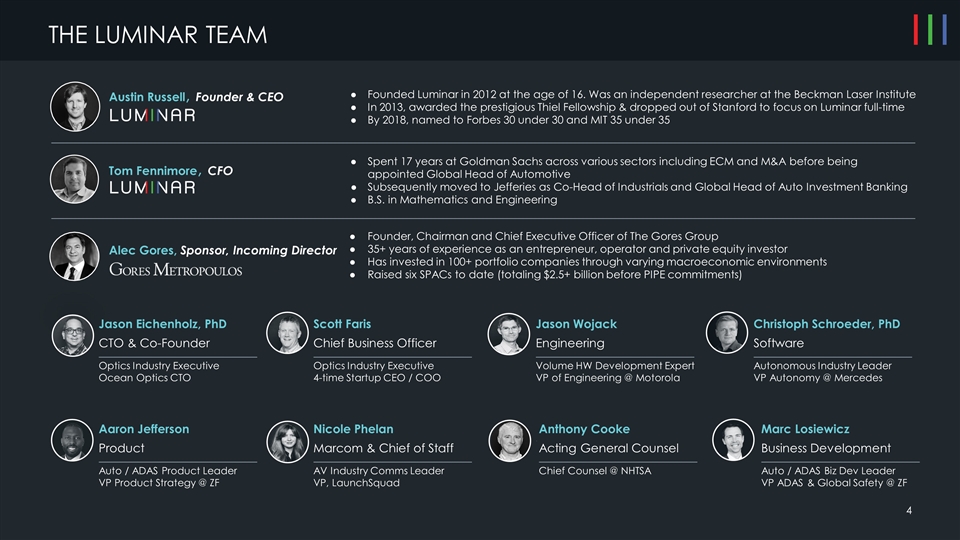

In connection with the execution of the Merger Agreement, the Company, First Merger Sub and Second Merger Sub entered into a support agreement

(the “Support Agreement”) with Austin Russell, who holds Luminar founders preferred stock and Luminar common stock representing approximately 38% of the voting power of Luminar capital stock (assuming that $170,000,000 of the Series

X Financing Amount (as defined in the Merger Agreement) is funded). The Support Agreement provides, among other things, that on (or effective as of) the third business day following the date that the consent solicitation statement/prospectus

included in the Registration Statement (as defined below) is disseminated, Mr. Russell will execute and deliver a written consent with respect to the outstanding shares of Luminar founders preferred stock and Luminar common stock held by

Mr. Russell adopting the Merger Agreement and approving the Mergers; provided, that in the event Luminar’s board of directors makes a Company Change in Recommendation (as defined in the Merger Agreement), Mr. Russell would only be

required to vote a number of his Luminar shares in favor of the Mergers that would equal 35% of the total number of shares of Luminar capital stock on an as-converted basis, and would be entitled, in his sole

discretion, to vote his remaining shares in any manner. In addition, the Support Agreement prohibits Mr. Russell from engaging in activities that have the effect of soliciting a competing Acquisition Proposal (as defined in the Merger

Agreement).

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K (this “Current

Report”) is incorporated by reference herein. The shares of Company Class B common stock to be issued in connection with the Merger Agreement and the transactions contemplated thereby, including the Mergers, will not be registered

under the Securities Act of 1933, as amended (the “Securities Act”), and will be issued in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act and/or Regulation D

promulgated thereunder as a transaction by an issuer not involving a public offering.

On August 24, 2020, the Company issued a press release announcing the execution of the Merger Agreement. The press release is attached

hereto as Exhibit 99.1 and incorporated by reference herein. Notwithstanding the foregoing, information contained on the Company’s or Luminar’s website and the websites of any of their affiliates referenced in Exhibit 99.1 or linked

therein or otherwise connected thereto does not constitute part of nor is it incorporated by reference into this Current Report.

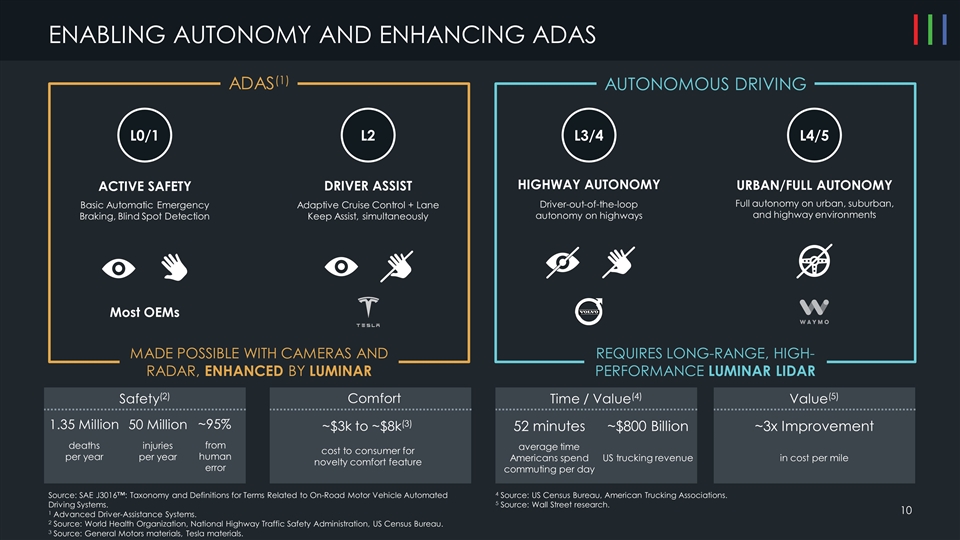

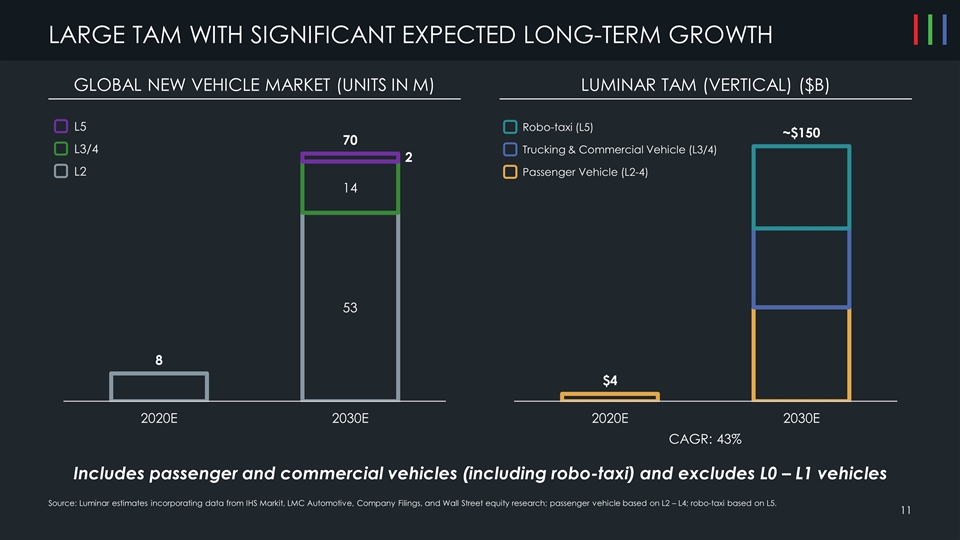

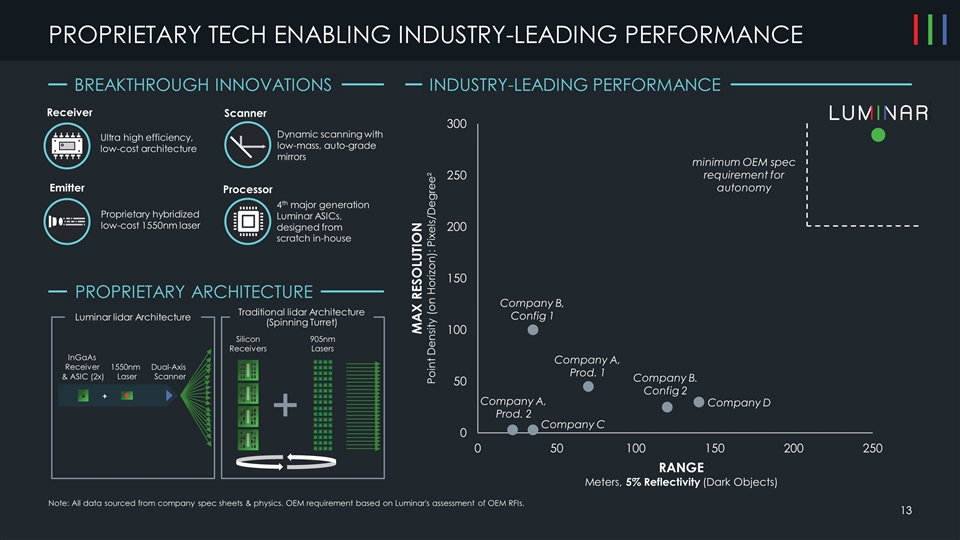

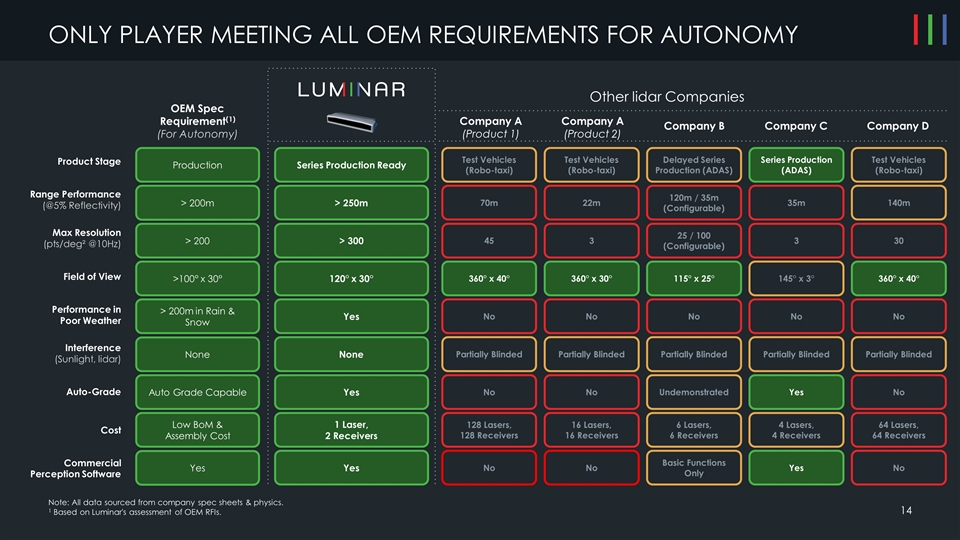

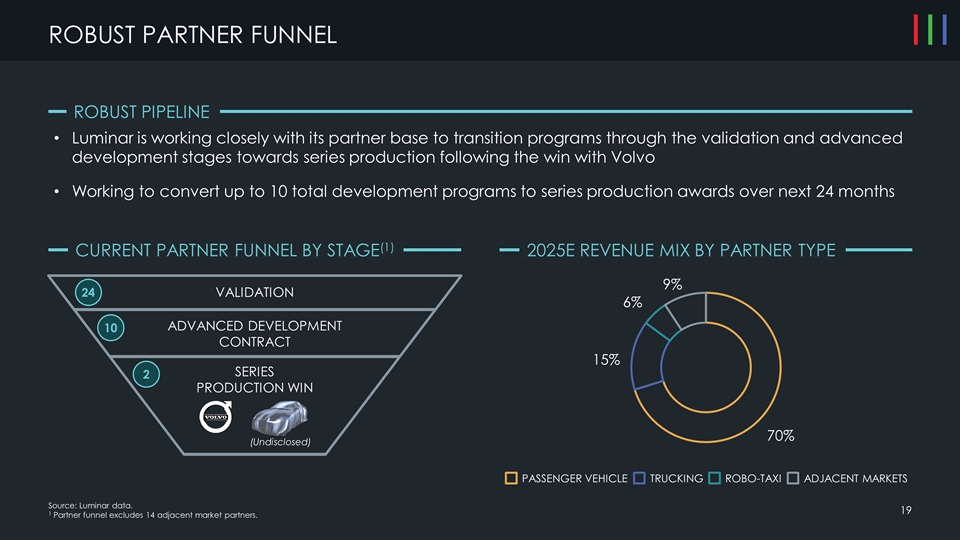

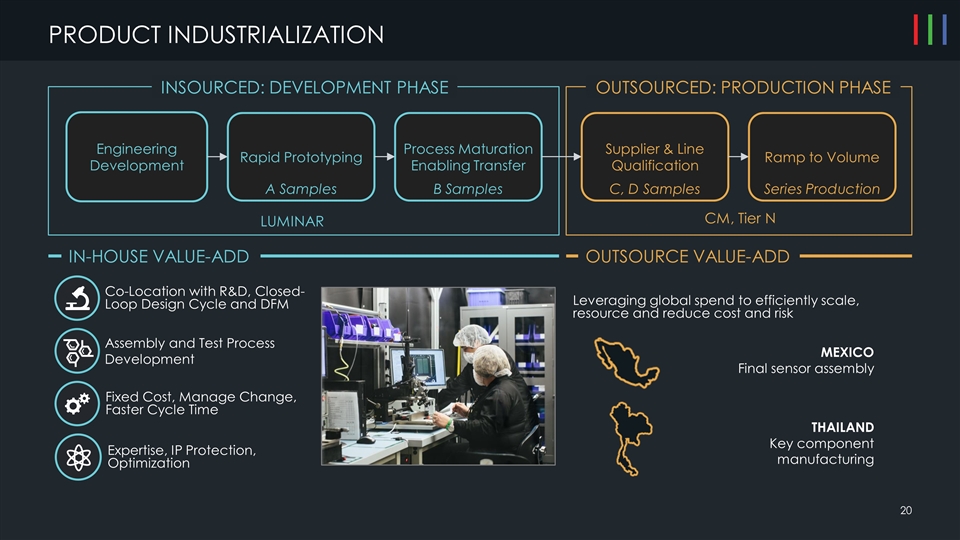

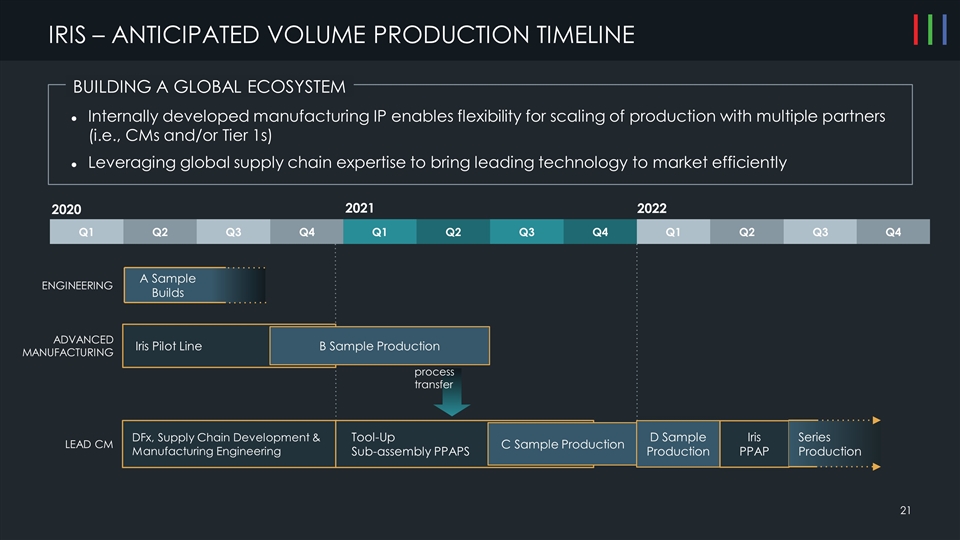

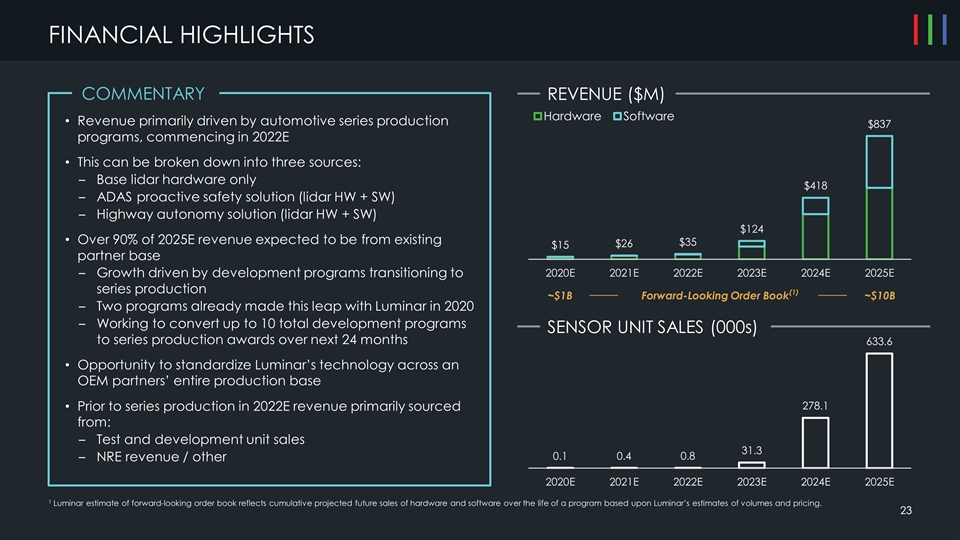

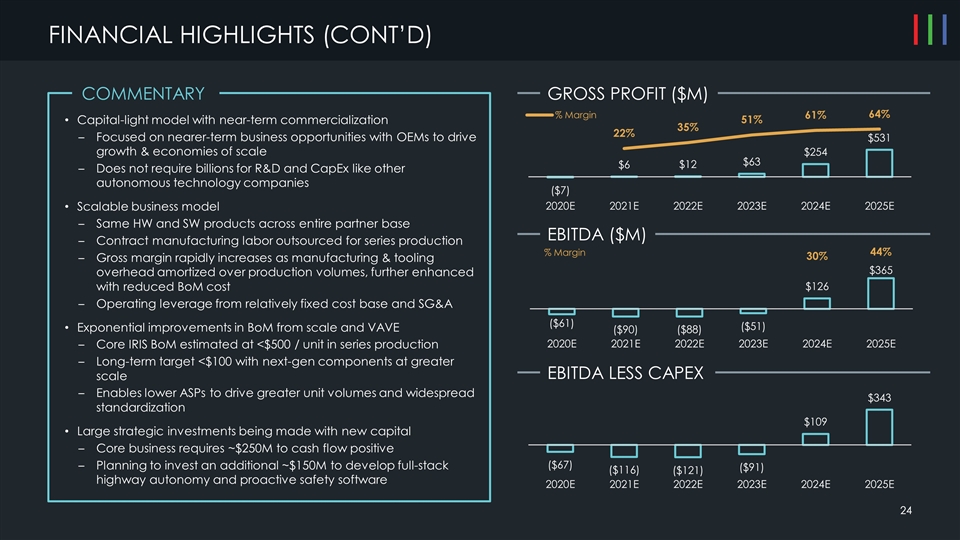

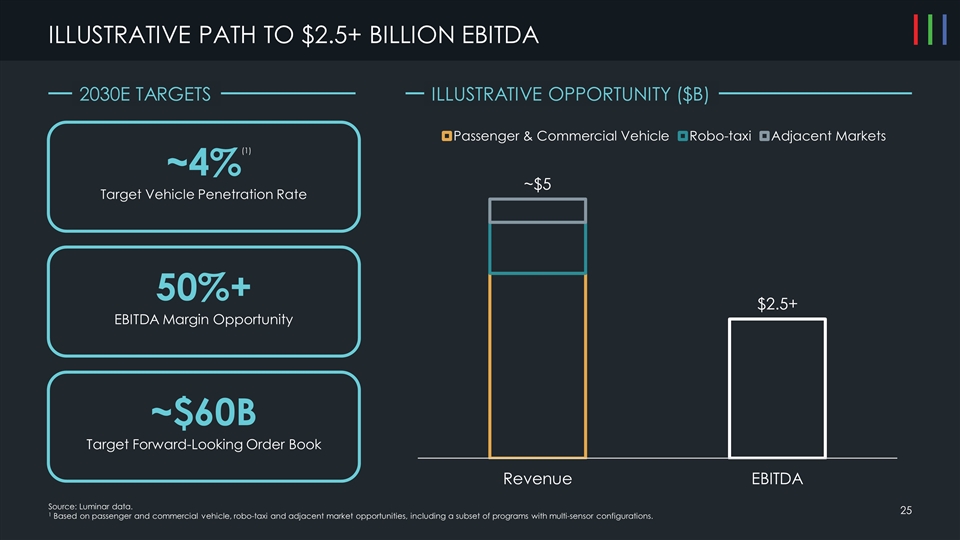

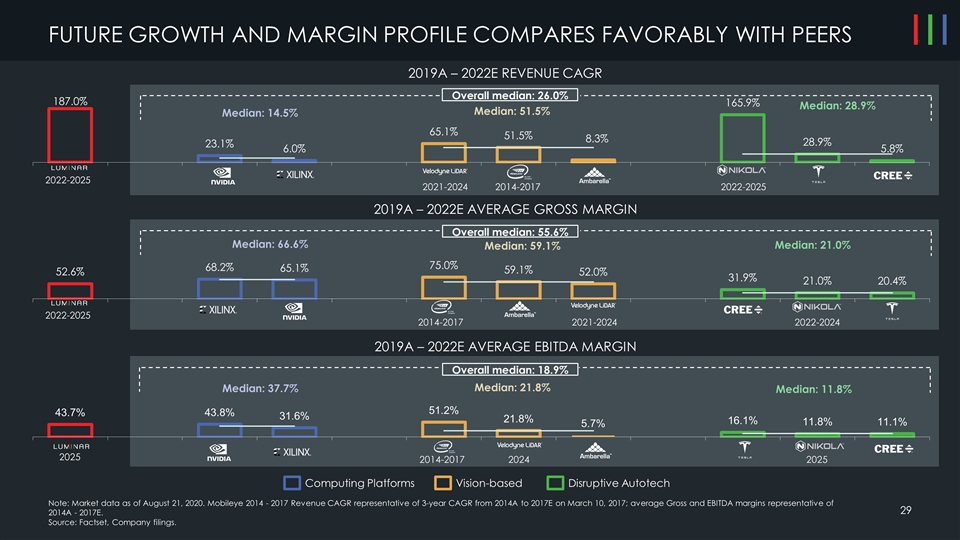

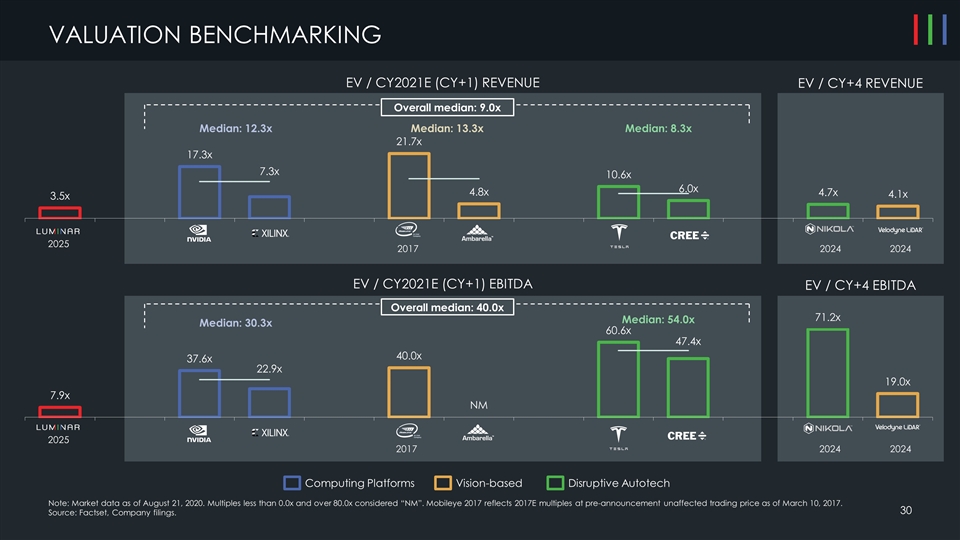

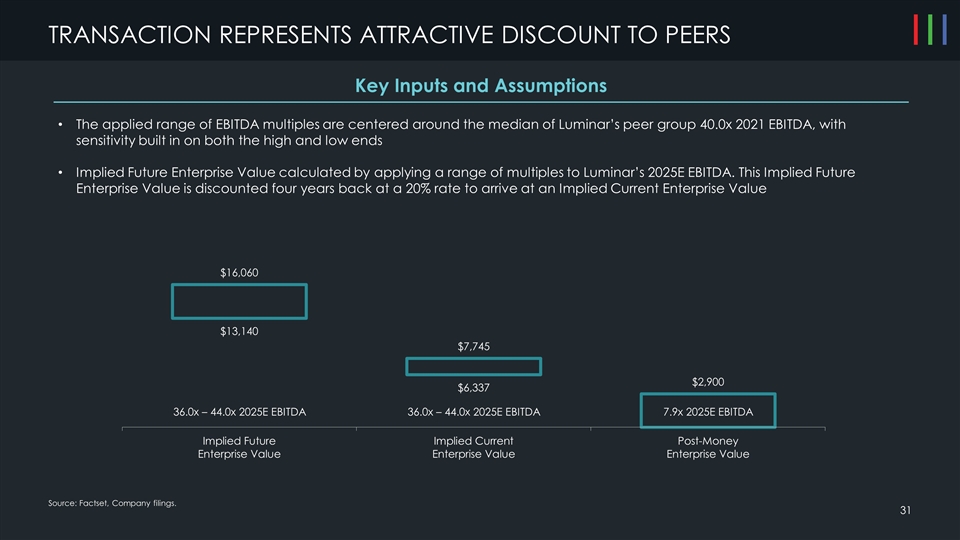

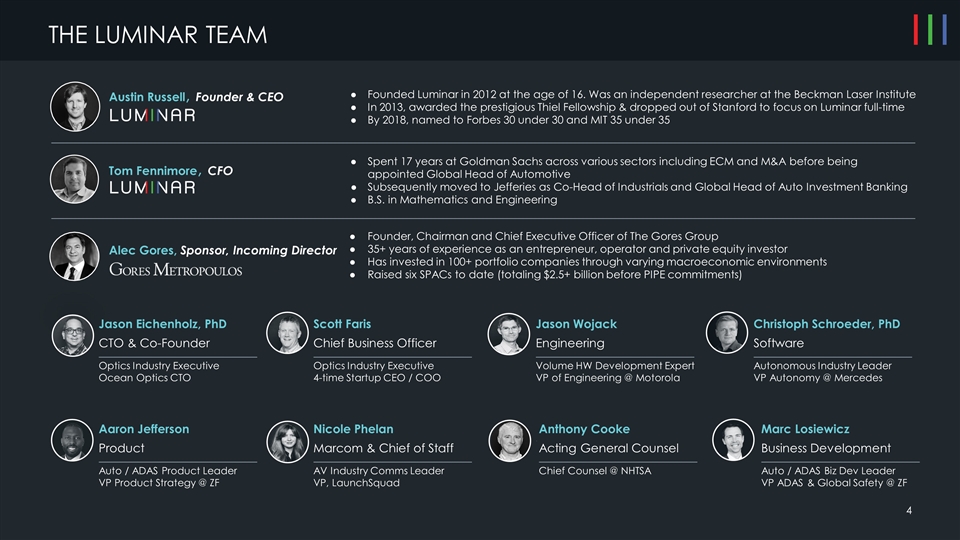

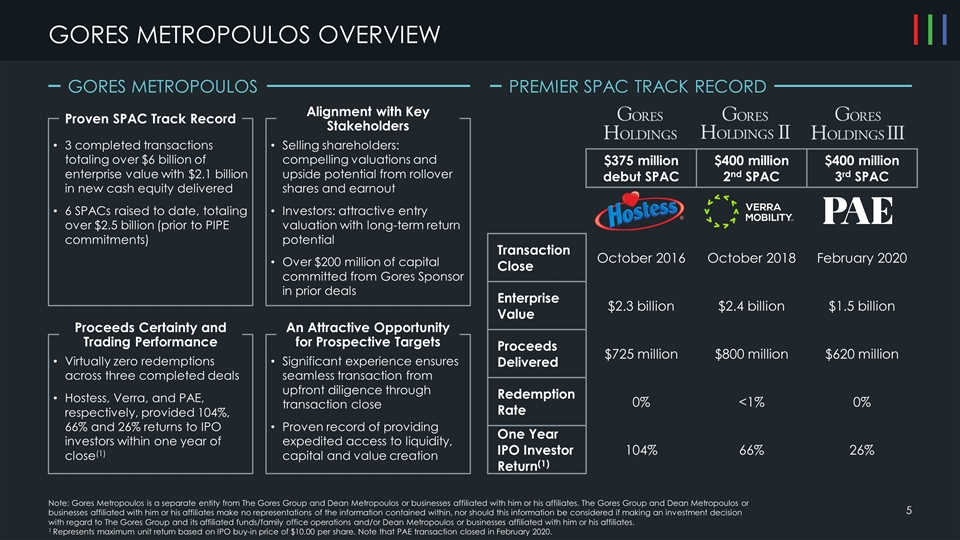

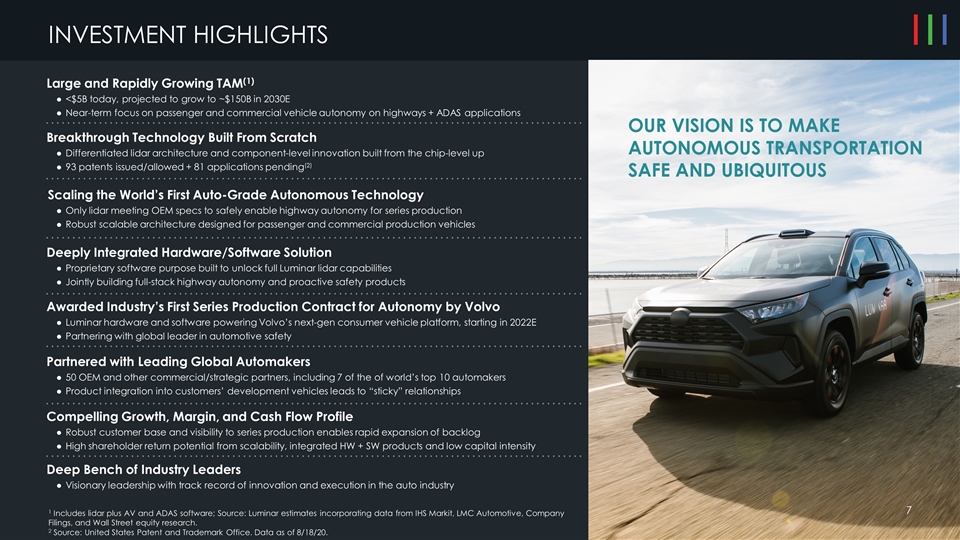

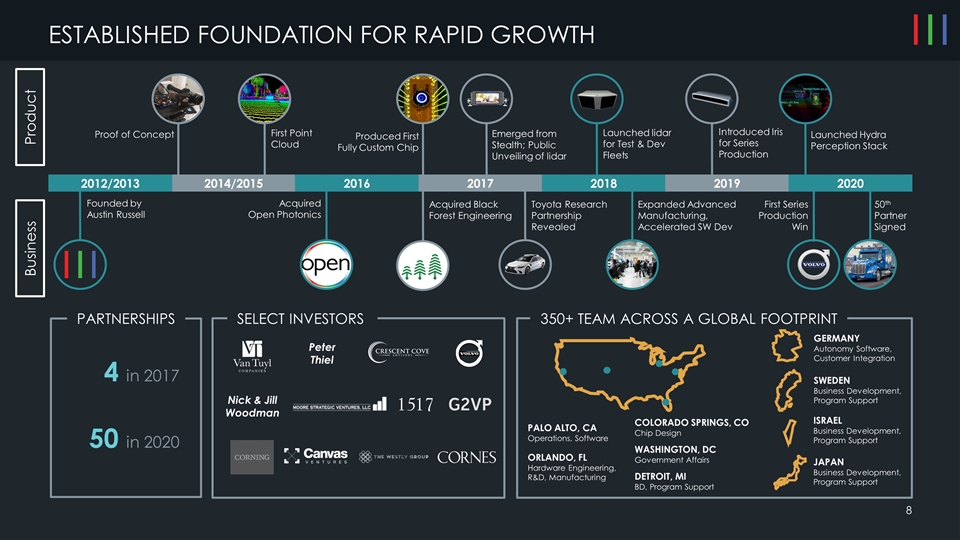

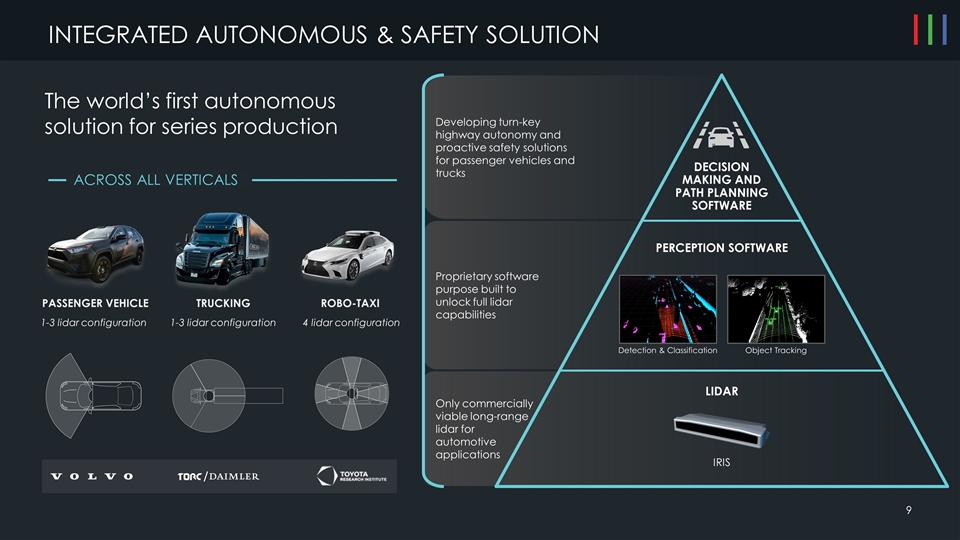

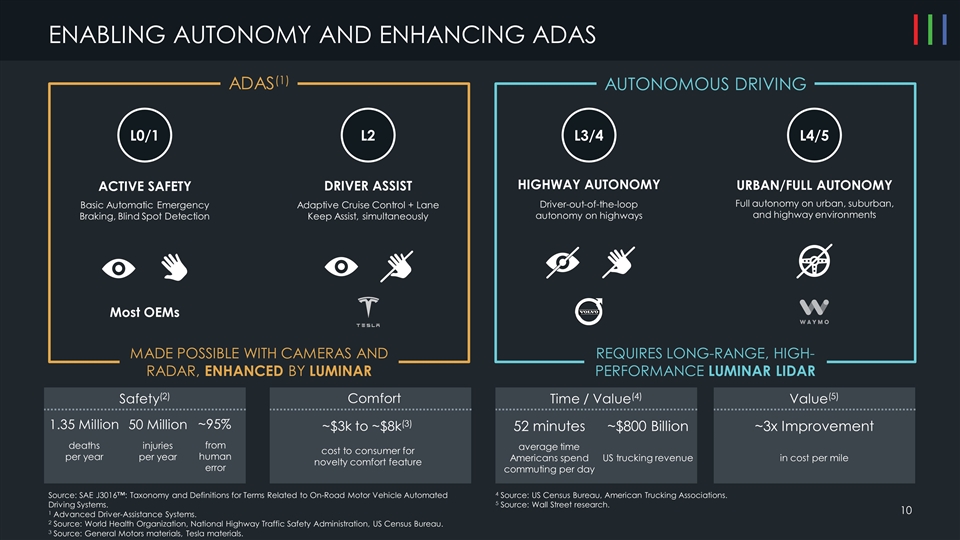

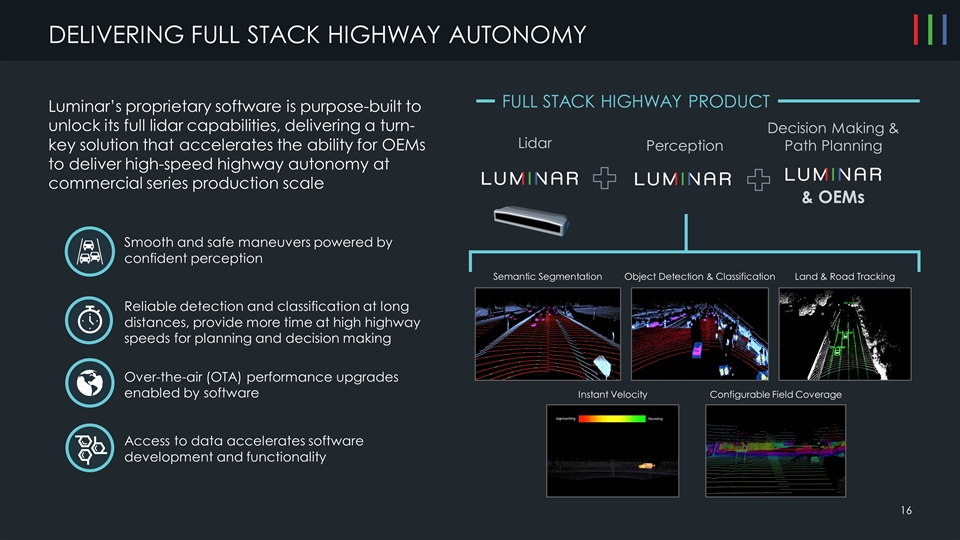

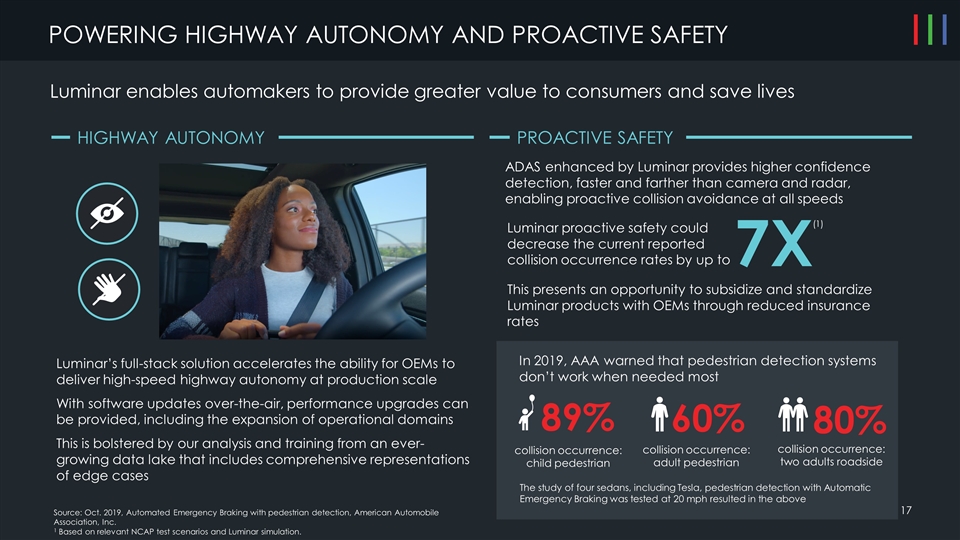

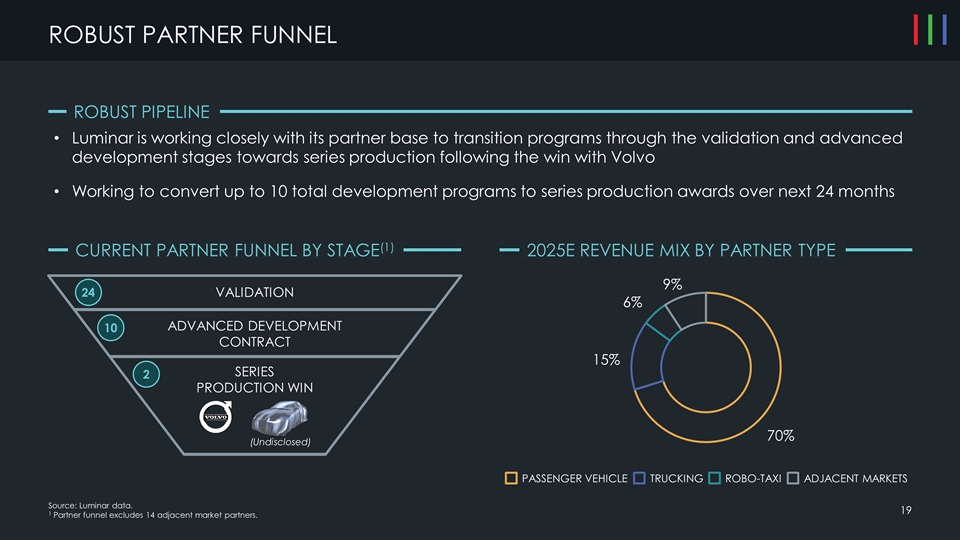

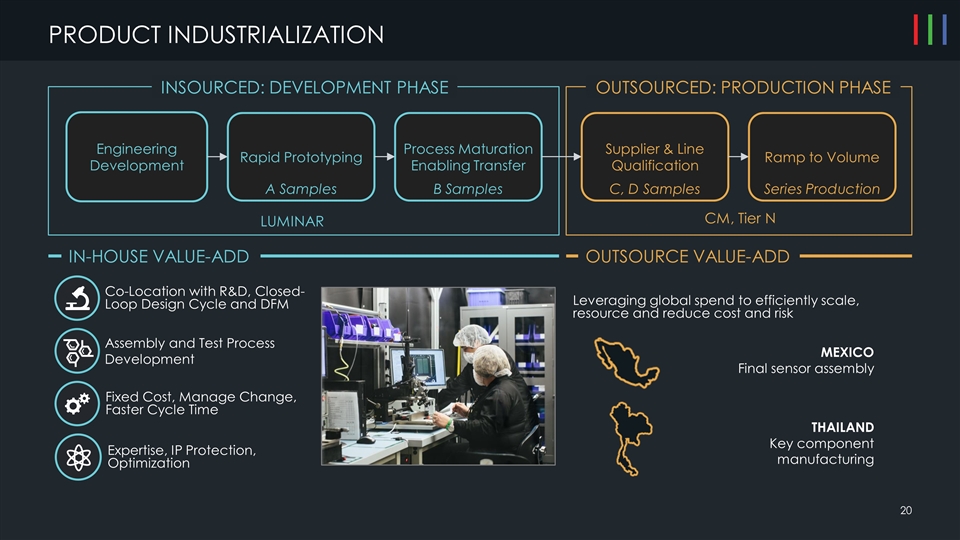

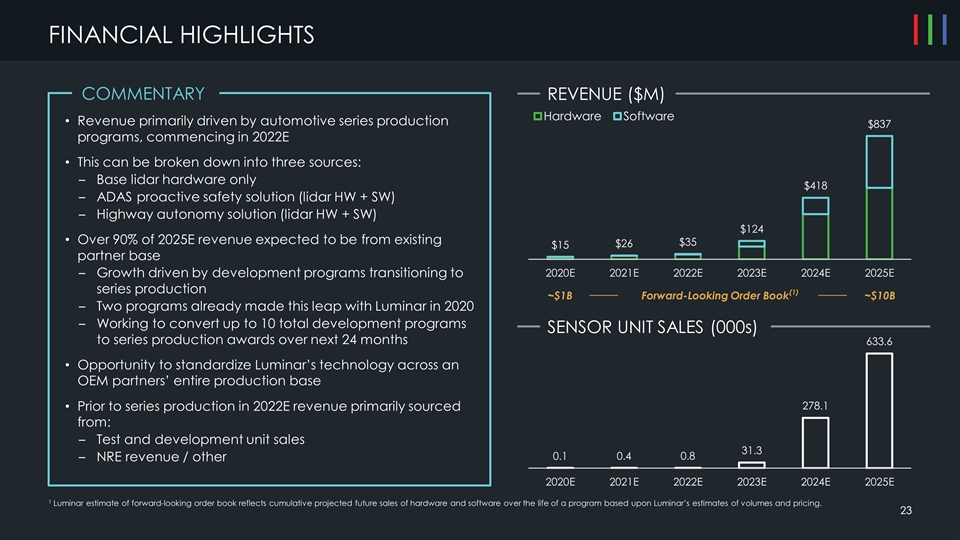

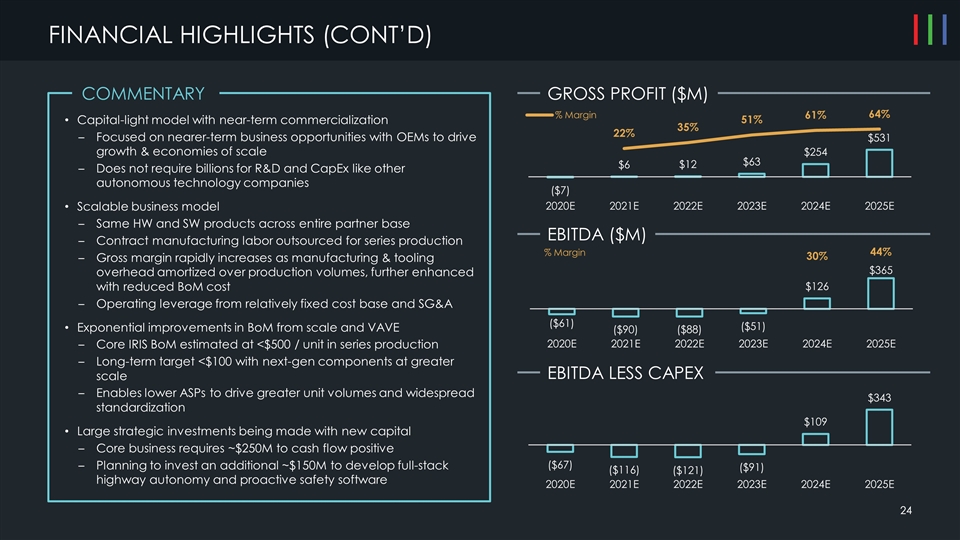

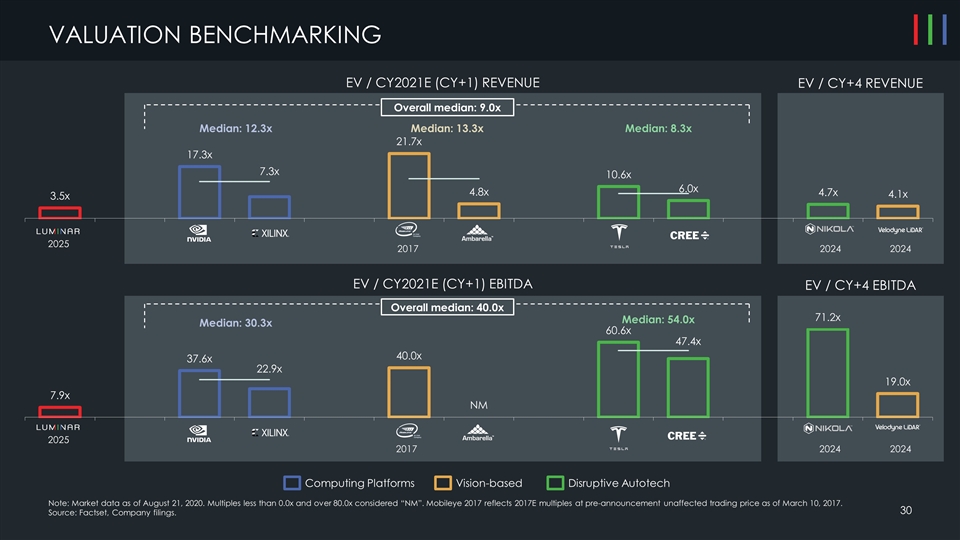

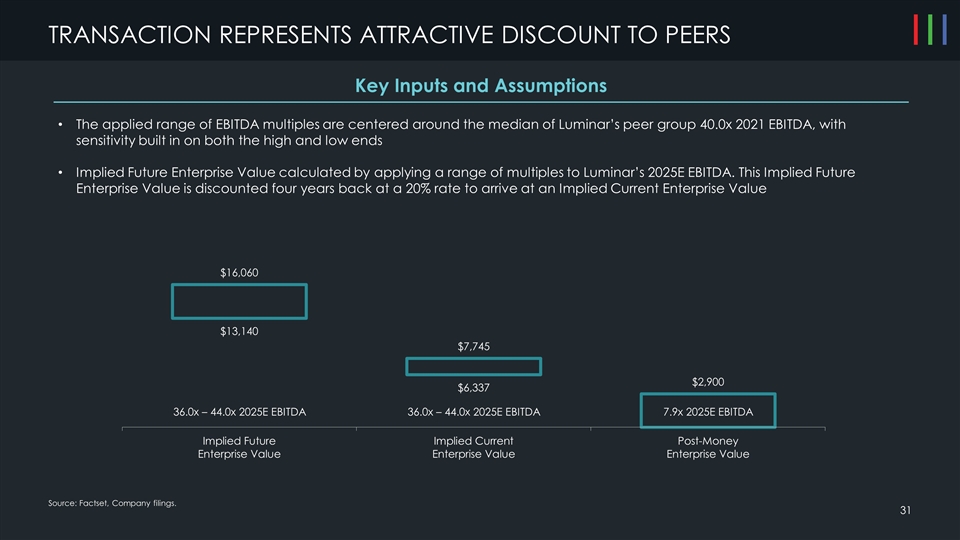

Attached

as Exhibit 99.2 and incorporated by reference herein is the investor presentation dated August 24, 2020 that will be used by the Company and Luminar with respect to the transactions contemplated by the Merger Agreement.

Additional Information about the Transactions and Where to Find It

In connection with the proposed transactions contemplated by the Merger Agreement, the Company intends to file with the SEC a registration

statement on Form S-4 (the “Registration Statement”) that will include a proxy statement, consent solicitation statement and prospectus with respect to the Company’s securities to be

issued in connection with the proposed transactions contemplated by the Merger Agreement that also constitutes a prospectus of the Company and will mail a definitive proxy statement/consent solicitation statement/prospectus and other relevant

documents to its stockholders. The definitive proxy statement/consent solicitation statement/prospectus will contain important information about the proposed transactions contemplated by the Merger Agreement and the other matters to be voted upon at

a meeting of the Company’s stockholders to be held to approve the proposed transactions contemplated by the Merger Agreement and other matters (the “Special Meeting”) and is not intended to provide the basis for any

investment decision or any other decision in respect of such matters. Company stockholders and other interested persons are advised to read, when available, the Registration Statement and the proxy statement/consent solicitation

statement/prospectus, as well as any amendments or supplements thereto, because they will contain important information about the proposed transactions. When available, the definitive proxy statement/consent solicitation statement/prospectus will be

mailed to Company stockholders as of a record date to be established for voting on the proposed transactions contemplated by the Merger Agreement and the other matters to be voted upon at the Special Meeting. Company stockholders will also be able

to obtain copies of the proxy statement/consent solicitation statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to: Gores Metropoulos, Inc., 9800 Wilshire

Boulevard, Beverly Hills, CA 90212, attention: Jennifer Kwon Chou (email: jchou@gores.com).

Participants in Solicitation

The Company and its directors and officers may be deemed participants in the solicitation of proxies of Company stockholders in connection with

the proposed transactions. Company stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of the Company in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 13, 2020. Information regarding the persons who may, under SEC rules, be deemed

participants in the solicitation of proxies to Company stockholders in connection with the proposed transactions contemplated by the Merger Agreement and other matters to be voted upon at the Special Meeting will be set forth in the proxy

statement/consent solicitation statement/prospectus for the proposed transactions when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transactions will be

included in the Registration Statement that the Company intends to file with the SEC.

Forward Looking Statements

This Current Report may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include information concerning the Company’s or Luminar’s possible or assumed future results of operations, business strategies, debt levels, competitive position, industry environment, potential growth

opportunities and the effects of regulation, including whether this transaction will generate returns for stockholders. These forward-looking statements are based on the Company’s or Luminar’s management’s current expectations,

estimates, projections and beliefs, as well as a number of assumptions concerning future events. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar

expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These

forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s or

Luminar’s management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not

limited to: (a) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement and the proposed transactions contemplated thereby; (b) the inability to complete the transactions

contemplated by the Merger Agreement due to the failure to obtain approval of the stockholders of the Company or other conditions to closing in the Merger Agreement; (c) the ability to meet Nasdaq’s listing standards following the

consummation of the transactions contemplated by the Merger Agreement; (d) the risk that the proposed transactions disrupt current plans and operations of Luminar or its subsidiaries as a result of the announcement and consummation of the

transactions described herein; (e) the ability to recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth

profitably, maintain relationships with customers and suppliers and retain its management and key employees; (f) costs related to the proposed transactions; (g) changes in applicable laws or regulations; (h) the possibility that

Luminar may be adversely affected by other economic, business and/or competitive factors; and (i) other risks and uncertainties indicated from time to time in the final prospectus of the Company, including those under “Risk Factors”

therein, and other documents filed or to be filed with the SEC by the Company. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Forward-looking statements included in this Current Report speak only as of the date of this Current Report. Except as required by law,

neither the Company nor Luminar undertakes any obligation to update or revise its forward-looking statements to reflect events or circumstances after the date of this release. Additional risks and uncertainties are identified and discussed in the

Company’s reports filed with the SEC and available at the SEC’s website at www.sec.gov.

Disclaimer

This communication is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any

securities pursuant to the proposed transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Exhibit |

|

|

| 2.1* |

|

Merger Agreement, dated as of August 24, 2020, by and among Gores Metropoulos, Inc., Dawn Merger Sub, Inc., Dawn Merger Sub II, LLC and Luminar Technologies, Inc. |

|

|

| 10.1 |

|

Support Agreement, dated as of August 24, 2020, by and among Gores Metropoulos, Inc., Dawn Merger Sub, Inc., Dawn Merger Sub II, LLC and Austin Russell. |

|

|

| 99.1 |

|

Press Release issued by the Company on August 24, 2020. |

|

|

| 99.2 |

|

Investor Presentation of the Company dated August 24, 2020. |

|

|

| 104 |

|

The cover page of the Current Report on Form 8-K, formatted in Inline XBRL. |

| * |

The schedules to this Exhibit have been omitted in accordance with Regulation

S-K Item 601(b)(2). The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Gores Metropoulos, Inc. |

|

|

|

|

| Date: August 24, 2020 |

|

|

|

By: |

|

/s/ Andrew McBride |

|

|

|

|

Name: |

|

Andrew McBride |

|

|

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

|

|

and Secretary |

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

dated as of

August 24, 2020

by and among

GORES

METROPOULOS, INC.,

DAWN MERGER SUB, INC.,

DAWN MERGER SUB II, LLC,

and

LUMINAR TECHNOLOGIES, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I CERTAIN DEFINITIONS |

|

|

2 |

|

| 1.01 |

|

Definitions |

|

|

2 |

|

| 1.02 |

|

Construction |

|

|

22 |

|

| 1.03 |

|

Knowledge |

|

|

23 |

|

| ARTICLE II THE MERGERS; CLOSING |

|

|

23 |

|

| 2.01 |

|

The Mergers |

|

|

23 |

|

| 2.02 |

|

Effects of the Mergers |

|

|

24 |

|

| 2.03 |

|

Closing |

|

|

24 |

|

| 2.04 |

|

Closing Certificates |

|

|

25 |

|

| 2.05 |

|

Certificate of Incorporation and Bylaws of the Surviving Corporation and the Surviving

Entity |

|

|

25 |

|

| 2.06 |

|

Directors and Officers of the Surviving Corporation and the Surviving Entity |

|

|

25 |

|

| 2.07 |

|

Tax Free Reorganization Matters |

|

|

26 |

|

| ARTICLE III EFFECTS OF THE MERGERS |

|

|

26 |

|

| 3.01 |

|

Treatment of Capital Stock in the First Merger |

|

|

26 |

|

| 3.02 |

|

Treatment of Capital Stock and Equity Interests in the Second Merger |

|

|

27 |

|

| 3.03 |

|

Equitable Adjustments |

|

|

28 |

|

| 3.04 |

|

Delivery of Per Share Company Stock Consideration |

|

|

28 |

|

| 3.05 |

|

Conversion of Company Equity Awards |

|

|

28 |

|

| 3.06 |

|

Conversion of Company Warrants |

|

|

29 |

|

| 3.07 |

|

Withholding |

|

|

30 |

|

| 3.08 |

|

Cash in Lieu of Fractional Shares |

|

|

30 |

|

| 3.09 |

|

Payment of Expenses and Company Indebtedness |

|

|

30 |

|

| 3.10 |

|

Dissenting Shares |

|

|

30 |

|

| ARTICLE IV EARN OUT |

|

|

31 |

|

| 4.01 |

|

Issuance of Earn Out Shares |

|

|

31 |

|

| 4.02 |

|

Acceleration Event |

|

|

33 |

|

| 4.03 |

|

Tax Treatment of Earn Out Shares |

|

|

33 |

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

|

33 |

|

| 5.01 |

|

Corporate Organization of the Company |

|

|

33 |

|

| 5.02 |

|

Subsidiaries |

|

|

34 |

|

i

|

|

|

|

|

|

|

| 5.03 |

|

Due Authorization |

|

|

34 |

|

| 5.04 |

|

No Conflict |

|

|

35 |

|

| 5.05 |

|

Governmental Authorities; Consents |

|

|

35 |

|

| 5.06 |

|

Capitalization |

|

|

36 |

|

| 5.07 |

|

Financial Statements |

|

|

38 |

|

| 5.08 |

|

Undisclosed Liabilities |

|

|

38 |

|

| 5.09 |

|

Litigation and Proceedings |

|

|

38 |

|

| 5.10 |

|

Compliance with Laws |

|

|

39 |

|

| 5.11 |

|

Intellectual Property |

|

|

40 |

|

| 5.12 |

|

Data Privacy |

|

|

43 |

|

| 5.13 |

|

Contracts; No Defaults |

|

|

44 |

|

| 5.14 |

|

Company Benefit Plans |

|

|

47 |

|

| 5.15 |

|

Labor Matters |

|

|

49 |

|

| 5.16 |

|

Taxes |

|

|

51 |

|

| 5.17 |

|

Brokers’ Fees |

|

|

53 |

|

| 5.18 |

|

Insurance |

|

|

53 |

|

| 5.19 |

|

Real Property; Tangible Property |

|

|

54 |

|

| 5.20 |

|

Environmental Matters |

|

|

55 |

|

| 5.21 |

|

Absence of Changes |

|

|

55 |

|

| 5.22 |

|

Significant Customers and Suppliers |

|

|

56 |

|

| 5.23 |

|

SBA PPP Loan |

|

|

56 |

|

| 5.24 |

|

Affiliate Agreements |

|

|

56 |

|

| 5.25 |

|

Internal Controls |

|

|

57 |

|

| 5.26 |

|

Permits |

|

|

57 |

|

| 5.27 |

|

Registration Statement |

|

|

57 |

|

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF PARENT, FIRST MERGER SUB AND SECOND

MERGER SUB |

|

|

57 |

|

| 6.01 |

|

Corporate Organization |

|

|

58 |

|

| 6.02 |

|

Due Authorization |

|

|

58 |

|

| 6.03 |

|

No Conflict |

|

|

59 |

|

| 6.04 |

|

Litigation and Proceedings |

|

|

60 |

|

| 6.05 |

|

Compliance with Laws |

|

|

60 |

|

| 6.06 |

|

Employee Benefit Plans |

|

|

61 |

|

| 6.07 |

|

Governmental Authorities; Consents |

|

|

62 |

|

| 6.08 |

|

Trust Account |

|

|

62 |

|

ii

|

|

|

|

|

|

|

| 6.09 |

|

Taxes |

|

|

63 |

|

| 6.10 |

|

Brokers’ Fees |

|

|

64 |

|

| 6.11 |

|

Parent SEC Reports; Financial Statements; Sarbanes-Oxley Act |

|

|

64 |

|

| 6.12 |

|

Business Activities; Absence of Changes |

|

|

66 |

|

| 6.13 |

|

Registration Statement |

|

|

67 |

|

| 6.14 |

|

Capitalization |

|

|

68 |

|

| 6.15 |

|

Parent Listing |

|

|

69 |

|

| 6.16 |

|

Contracts; No Defaults |

|

|

70 |

|

| 6.17 |

|

Investment Company Act; JOBS Act |

|

|

70 |

|

| 6.18 |

|

Affiliate Agreements |

|

|

70 |

|

| 6.19 |

|

Parent Stockholders |

|

|

70 |

|

| ARTICLE VII COVENANTS OF THE COMPANY |

|

|

71 |

|

| 7.01 |

|

Conduct of Business |

|

|

71 |

|

| 7.02 |

|

Inspection |

|

|

74 |

|

| 7.03 |

|

Termination of Certain Agreements |

|

|

75 |

|

| 7.04 |

|

No Parent Securities Transactions |

|

|

75 |

|

| 7.05 |

|

No Claim Against the Trust Account |

|

|

75 |

|

| 7.06 |

|

Proxy Solicitation; Other Actions |

|

|

76 |

|

| 7.07 |

|

Non-Solicitation; Acquisition Proposals |

|

|

76 |

|

| 7.08 |

|

Company Warrant Amendments |

|

|

80 |

|

| ARTICLE VIII COVENANTS OF PARENT |

|

|

80 |

|

| 8.01 |

|

Indemnification and Insurance |

|

|

80 |

|

| 8.02 |

|

Conduct of Parent During the Interim Period |

|

|

81 |

|

| 8.03 |

|

Trust Account |

|

|

83 |

|

| 8.04 |

|

Inspection |

|

|

84 |

|

| 8.05 |

|

Parent Nasdaq Listing |

|

|

84 |

|

| 8.06 |

|

Parent Public Filings |

|

|

84 |

|

| 8.07 |

|

Section 16 Matters |

|

|

84 |

|

| 8.08 |

|

Director Appointments |

|

|

84 |

|

| 8.09 |

|

Exclusivity |

|

|

85 |

|

| 8.10 |

|

Bylaws |

|

|

85 |

|

| 8.11 |

|

Insider Letters |

|

|

85 |

|

| ARTICLE IX JOINT COVENANTS |

|

|

85 |

|

| 9.01 |

|

Support of Transaction |

|

|

85 |

|

iii

|

|

|

|

|

|

|

| 9.02 |

|

Preparation of Registration Statement; Special Meeting; Solicitation of Company Requisite

Approval |

|

|

86 |

|

| 9.03 |

|

Other Filings; Press Release |

|

|

89 |

|

| 9.04 |

|

Confidentiality; Communications Plan |

|

|

89 |

|

| 9.05 |

|

Regulatory Approvals |

|

|

90 |

|

| 9.06 |

|

Management Longer Term Equity Incentive Plan; Parent Omnibus Incentive Plan |

|

|

91 |

|

| 9.07 |

|

FIRPTA |

|

|

92 |

|

| 9.08 |

|

Other Transactions; Transaction Agreements |

|

|

92 |

|

| ARTICLE X CONDITIONS TO OBLIGATIONS |

|

|

92 |

|

| 10.01 |

|

Conditions to Obligations of All Parties |

|

|

92 |

|

| 10.02 |

|

Additional Conditions to Obligations of Parent |

|

|

93 |

|

| 10.03 |

|

Additional Conditions to the Obligations of the Company |

|

|

93 |

|

| ARTICLE XI TERMINATION/EFFECTIVENESS |

|

|

94 |

|

| 11.01 |

|

Termination |

|

|

94 |

|

| 11.02 |

|

Effect of Termination |

|

|

96 |

|

| ARTICLE XII MISCELLANEOUS |

|

|

98 |

|

| 12.01 |

|

Waiver |

|

|

98 |

|

| 12.02 |

|

Notices |

|

|

98 |

|

| 12.03 |

|

Assignment |

|

|

99 |

|

| 12.04 |

|

Rights of Third Parties |

|

|

99 |

|

| 12.05 |

|

Expenses |

|

|

99 |

|

| 12.06 |

|

Governing Law |

|

|

99 |

|

| 12.07 |

|

Captions; Counterparts |

|

|

100 |

|

| 12.08 |

|

Schedules and Exhibits |

|

|

100 |

|

| 12.09 |

|

Entire Agreement |

|

|

100 |

|

| 12.10 |

|

Amendments |

|

|

100 |

|

| 12.11 |

|

Severability |

|

|

101 |

|

| 12.12 |

|

Jurisdiction; WAIVER OF TRIAL BY JURY |

|

|

101 |

|

| 12.13 |

|

Enforcement |

|

|

101 |

|

| 12.14 |

|

Non-Recourse |

|

|

102 |

|

| 12.15 |

|

Nonsurvival of Representations, Warranties and Covenants |

|

|

102 |

|

| 12.16 |

|

Acknowledgements |

|

|

102 |

|

| 12.17 |

|

Privileged Communications |

|

|

103 |

|

iv

Exhibits

Exhibit A – Form of Support Agreement

Exhibit B –

Form of A&R Registration Rights Agreement

Exhibit C – Form of Lockup Agreement

Exhibit D – Form of A&R Certificate of Incorporation of Parent

Exhibit E – Form of A&R Bylaws of Parent

Exhibit F

– Form of Letter of Transmittal

v

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger (this “Agreement”), dated as of August 24, 2020, is entered into by and among Gores

Metropoulos, Inc., a Delaware corporation (“Parent”), Dawn Merger Sub, Inc., a Delaware corporation (“First Merger Sub”), Dawn Merger Sub II, LLC, a Delaware limited liability company (“Second Merger

Sub”), and Luminar Technologies, Inc., a Delaware corporation (the “Company”). Except as otherwise indicated, capitalized terms used but not defined herein shall have the meanings set forth in

Article I of this Agreement.

RECITALS

WHEREAS, Parent is a blank check company incorporated to acquire one or more operating businesses through a Business Combination;

WHEREAS, First Merger Sub and Second Merger Sub are newly formed, wholly owned, direct subsidiaries of Parent, and were formed for the sole

purpose of the Mergers;

WHEREAS, subject to the terms and conditions hereof, at the Closing, (a) First Merger Sub is to merge with

and into the Company pursuant to the First Merger, with the Company surviving as the Surviving Corporation and (b) immediately following the First Merger and as part of the same overall transaction as the First Merger, the Surviving Corporation

is to merge with and into Second Merger Sub pursuant to the Second Merger, with Second Merger Sub surviving as the Surviving Entity;

WHEREAS, the respective boards of directors of each of Parent, First Merger Sub, Second Merger Sub and the Company have each approved and

declared advisable the Transactions upon the terms and subject to the conditions of this Agreement and in accordance with the Delaware General Corporation Law (the “DGCL”) and the General Limited Liability Company Act of the State

of Delaware (“DLLCA”), as applicable;

WHEREAS, contemporaneously with the execution and delivery of this Agreement, in

connection with the Transactions certain Company Stockholders have entered into Support Agreements, dated as of the date hereof (the “Support Agreements”), in the form set forth on Exhibit A, with Parent,

First Merger Sub and Second Merger Sub;

WHEREAS, in connection with the consummation of the Mergers, Parent, Sponsor, the Company,

certain Parent Stockholders and certain Company Stockholders who will receive Parent Class A Stock and/or Parent Class B Stock pursuant to Article III, will enter into an amended and restated Registration Rights

Agreement (the “A&R Registration Rights Agreement”), in the form set forth on Exhibit B;

WHEREAS, in connection with the consummation of the Mergers, Parent, the Company and certain Company Stockholders who will receive Parent

Class A Stock and/or Parent Class B Stock pursuant to Article III will enter into a lockup agreement (each, a “Lockup Agreement”), in the form set forth on Exhibit C;

WHEREAS, pursuant to the Parent Organizational Documents, Parent shall provide an opportunity to its stockholders to have their Parent

Class A Stock redeemed for the consideration, and on the terms and subject to the conditions and limitations, set forth in this Agreement, the Parent Organizational Documents, the Trust Agreement, and the Proxy Statement in conjunction with,

among other things, obtaining approval from the stockholders of Parent for the Business Combination (the “Offer”);

WHEREAS, prior to the consummation of the Transactions, Parent shall, subject to obtaining

the Parent Stockholder Approval, adopt the amended and restated certificate of incorporation (the “Parent A&R Charter”) in the form set forth on Exhibit D, to provide for, among other things, the

authorization of the Parent Class B Stock to be issued in connection with the Transactions;

WHEREAS, prior to the consummation of

the Transactions, Parent shall adopt the amended and restated bylaws (the “Parent A&R Bylaws”) in the form set forth on Exhibit E; and

WHEREAS, each of the parties intends that, for U.S. federal income tax purposes, (a) this Agreement shall constitute a “plan of

reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986 (the “Code”) and the Treasury Regulations promulgated thereunder and (b) the Mergers shall be treated as an integrated transaction

and together shall constitute a single “reorganization” within the meaning of Section 368(a) of the Code (the “Intended Tax Treatment”), and this Agreement is hereby adopted as a “plan of reorganization”

within the meaning of U.S. Treasury Regulation Section 1.368-2(g).

NOW, THEREFORE, in

consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound hereby, Parent, First Merger Sub, Second Merger Sub and the Company agree as

follows:

ARTICLE I

CERTAIN DEFINITIONS

1.01 Definitions. As used herein, the following terms shall have the following meanings:

“A&R Registration Rights Agreement” has the meaning specified in the Recitals hereto.

“Acceptable Confidentiality Agreement” means a confidentiality agreement that contains confidentiality

provisions on terms no less favorable in the aggregate in any substantive respect to the Company than those contained in the Confidentiality Agreement (excluding any changes specifically necessary in order for the Company to be able to comply with

its obligations under this Agreement and such non-material changes requested by the counterparty to ensure the confidentiality agreement is consistent with its organization’s customary policies,

procedures and practices with respect to confidentiality agreements).

“Acquisition Proposal” means any

proposal or offer from any Person or “group” (as defined in the Exchange Act) (other than Parent, First Merger Sub, Second Merger Sub or their respective Affiliates or with respect to the Transactions) relating to, in a single transaction

or series of related transactions: (a) any direct or indirect acquisition or purchase of a business that constitutes 15% or more of the revenues, income or assets

2

of the Company and its Subsidiaries, taken as a whole; (b) any direct or indirect acquisition of 15% or more of the consolidated assets of the Company and its Subsidiaries, taken as a whole

(based on the fair market value thereof, as determined in good faith by the Company Board), including through the acquisition of one or more Subsidiaries of the Company owning such assets; (c) the acquisition of beneficial ownership, or the

right to acquire beneficial ownership, of 15% or more of the total voting power of the equity securities of the Company, any tender offer or exchange offer that if consummated would result in any Person beneficially owning 15% or more of the total

voting power of the equity securities of the Company, or any merger, reorganization, consolidation, share exchange, business combination, recapitalization, liquidation, dissolution or similar transaction involving the Company (or any Subsidiary of

the Company) that constitutes 15% or more of the revenues, income or assets of the Company and its Subsidiaries, taken as a whole; or (d) any issuance or sale or other disposition (including by way of merger, reorganization, division,

consolidation, share exchange, business combination, recapitalization or other similar transaction) of 15% or more of the total voting power of the equity securities of the Company.

“Action” means any Claim that is by or before any Governmental Authority.

“Additional Parent SEC Reports” has the meaning specified in Section 6.11(a).

“Additional Proposal” has the meaning specified in Section 9.02(c).

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is

controlled by, or is under common control with, such specified Person, through one or more intermediaries or otherwise.

“Aggregate Company Stock Consideration” means a number of shares of Parent Class A Stock or Parent

Class B Stock, as applicable in accordance with Section 3.01(a) and Section 3.01(b) (deemed to have a value of $10.00 per share), equal to (a)(i) $2,928,828,692, plus (ii) the

Subsequent Series X Financing Amount, if any, divided by (b) $10.00.

“Agreement” has the meaning

specified in the preamble hereto.

“Amendment Proposal” has the meaning specified in

Section 9.02(c).

“Anti-Corruption Laws” means any applicable Laws relating to

anti-bribery or anti-corruption (governmental or commercial), including Laws that prohibit the corrupt payment, offer, promise, or authorization of the payment or transfer of anything of value (including gifts or entertainment), directly or

indirectly, to any representative of a foreign Governmental Authority or commercial entity to obtain a business advantage, including the U.S. Foreign Corrupt Practices Act and all national and international Laws enacted to implement the OECD

Convention on Combating Bribery of Foreign Officials in International Business Transactions.

3

“Antitrust Law” means the HSR Act, the Federal Trade

Commission Act, as amended, the Sherman Act, as amended, the Clayton Act, as amended, and any applicable foreign antitrust Laws and all other applicable Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose

or effect of monopolization or restraint of trade or lessening of competition through merger or acquisition.

“Approval Requirement” has the meaning specified in Section 8.11.

“Assumed Warrant” has the meaning specified in Section 3.06.

“Business Combination” has the meaning ascribed to such term in the Certificate of Incorporation.

“Business Combination Proposal” has the meaning set forth in Section 8.09.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in

New York, New York are authorized or required by Law to close.

“CARES Act” means The

Coronavirus Aid, Relief, and Economic Security Act, Pub.L. 116–136 (03/27/2020), and applicable rules and regulations.

“Cash and Cash Equivalents” means the cash and cash equivalents, including checks, money orders, marketable

securities, short-term instruments, negotiable instruments, funds in time and demand deposits or similar accounts on hand, in lock boxes, in financial institutions or elsewhere, together with all accrued but unpaid interest thereon, and all bank,

brokerage or other similar accounts.

“Certificate of Incorporation” means the Amended and Restated

Certificate of Incorporation of Parent, filed with the Secretary of State of the State of Delaware on January 31, 2019.

“Change of Control” means any transaction or series of transactions the result of which is: (a) the

acquisition by any Person or “group” (as defined in the Exchange Act) of Persons of direct or indirect beneficial ownership of securities representing 50% or more of the combined voting power of the then outstanding securities of Parent;

(b) a merger, consolidation, reorganization or other business combination, however effected, resulting in any Person or “group” (as defined in the Exchange Act) acquiring at least 50% of the combined voting power of the then

outstanding securities of Parent or the surviving Person outstanding immediately after such combination; or (c) a sale of all or substantially all of the assets of Parent and its Subsidiaries, taken as a whole.

“Claim” means any demand, claim, action, legal, judicial or administrative proceeding (whether at law or in

equity) or arbitration.

“Closing” has the meaning specified in Section 2.03.

“Closing Date” has the meaning specified in Section 2.03.

4

“Closing Form 8-K”

has the meaning specified in Section 9.03(c).

“Closing Parent Cash” means an

amount equal to (a) the funds contained in the Trust Account as of the Effective Time; plus (b) all other Cash and Cash Equivalents of Parent (excluding, for the avoidance of doubt, any amount in the foregoing clause (a));

minus (c) the aggregate amount of cash proceeds that will be required to satisfy the redemption of any shares of Parent Class A Stock pursuant to the Offer (to the extent not already paid).

“Closing Press Release” has the meaning specified in Section 9.03(c).

“Code” has the meaning specified in the Recitals hereto.

“Common Share Price” means the share price equal to the volume weighted average closing sale price of one

share of Parent Class A Stock as reported on Nasdaq (or the exchange on which the shares of Parent Class A Stock are then listed) for a period of at least twenty (20) days out of forty (40) consecutive trading days ending on the

trading day immediately prior to the date of determination (as adjusted as appropriate to reflect any stock splits, reverse stock splits, stock dividends (including any dividend or distribution of securities convertible into Parent Class A

Stock), extraordinary cash dividend (which adjustment shall be subject to the reasonable determination of the Parent Board), reorganization, recapitalization, reclassification, combination, exchange of shares or other like change or transaction with

respect to Parent Class A Stock).

“Communications Plan” has the meaning specified in

Section 9.04(b).

“Company” has the meaning specified in the preamble hereto.

“Company Affiliate Agreement” has the meaning specified in Section 5.24.

“Company Benefit Plan” has the meaning specified in Section 5.14(a).

“Company Board” means the board of directors of the Company.

“Company Board Recommendation” has the meaning specified in Section 9.02.

“Company Certificate of Incorporation” means the Amended and Restated Certificate of Incorporation of the

Company, filed with the Secretary of State of the State of Delaware on August 21, 2020.

“Company Change in

Recommendation” has the meaning specified in Section 9.02(g).

“Company

Class A Stock” means the Company’s Class A Common Stock, par value $0.00001 per share, as contemplated by the Company Certificate of Incorporation.

“Company Class B Stock” means the Company’s Class B Common Stock, par value

$0.00001 per share, as contemplated by the Company Certificate of Incorporation.

5

“Company Closing Certificate” has the meaning specified in

Section 2.04(b).

“Company Closing Indebtedness” has the meaning specified in

Section 2.04(b).

“Company Common Stock” means a share of the Company’s

Class A Stock or a share of the Company’s Class B Stock.

“Company Cure Period” has the

meaning specified in Section 11.01(a).

“Company Equity Awards” means the

Company Stock Options and shares of Company Restricted Stock granted under the Company Stock Plan.

“Company

Founders Preferred Stock” means the shares of the Company’s Founders Preferred Stock, par value $0.00001 per share.

“Company Intellectual Property” has the meaning specified in Section 5.11(b).

“Company Intervening Event” means an event, fact, development, circumstance or occurrence (but specifically

excluding any Acquisition Proposal, Superior Proposal, any changes in capital markets or any declines or improvements in financial markets) that materially affects the business, assets, operations or prospects of the Company and its Subsidiaries,

taken as a whole, and that was not known and was not reasonably foreseeable to the Company Board as of the date hereof (or the consequences of which were not reasonably foreseeable to the Company Board as of the date hereof), and that becomes known

to the Company Board after the date of this Agreement.

“Company Intervening Event Notice” has the meaning

specified in Section 7.07(d).

“Company Intervening Event Notice Period” has the

meaning specified in Section 7.07(d).

“Company Notice” has the meaning

specified in Section 7.07(c).

“Company Organizational Documents” means the

Company Certificate of Incorporation and the Company’s bylaws, in each case as may be amended from time to time in accordance with the terms of this Agreement.

“Company Preferred Stock” means, collectively, the Company Series A Preferred Stock, the Company Series A-1 Preferred Stock, the Company Series A-2 Preferred Stock, the Company Series A-3 Preferred Stock, the Company Series A-4 Preferred Stock, the Company Series A-5 Preferred Stock, the Company Series A-6 Preferred Stock, the Company Series A-7 Preferred Stock, the Company Series A-8 Preferred Stock, the Company Series A-9 Preferred Stock, the Company Series A-10 Preferred Stock, the Company Series A-11 Preferred Stock and the Company Series X Preferred Stock.

“Company Registered Intellectual Property” means all issued Patents, pending Patent applications, Trademark

registrations, applications for Trademark registration, Copyright registrations, applications for Copyright registration and Internet domain names, in each case included in the Owned Intellectual Property.

6

“Company Related Parties” means the Company, its

Subsidiaries and any of their respective former, current or future partners, stockholders, controlling Persons, managers, members, directors, officers, employees, Affiliates, representatives, agents or any of their respective assignees or successors

or any former, current or future partner, stockholder, controlling Person, manager, member, director, officer, employee, Affiliate, representative, agent, assignee or successor of any of the foregoing.

“Company Representations” means the representations and warranties of the Company expressly and specifically

set forth in Article V of this Agreement, as qualified by the Company Schedules. For the avoidance of doubt, the Company Representations are solely made by the Company.

“Company Requisite Approval” has the meaning specified in Section 5.03(a).

“Company Restricted Stock” means the restricted shares of Company Common Stock granted pursuant to the Company

Stock Plan.

“Company Schedules” means the disclosure schedules of the Company and its Subsidiaries.

“Company Series A Preferred Stock” means the shares of the Company’s Series A Preferred Stock, par value

$0.00001 per share.

“Company Series A-1 Preferred Stock” means

the shares of the Company’s Series A-1 Preferred Stock, par value $0.00001 per share.

“Company Series A-2 Preferred Stock” means the shares of the

Company’s Series A-2 Preferred Stock, par value $0.00001 per share.

“Company Series A-3 Preferred Stock” means the shares of the

Company’s Series A-3 Preferred Stock, par value $0.00001 per share.

“Company Series A-4 Preferred Stock” means the shares of the

Company’s Series A-4 Preferred Stock, par value $0.00001 per share.

“Company Series A-5 Preferred Stock” means the shares of the

Company’s Series A-5 Preferred Stock, par value $0.00001 per share.

“Company Series A-6 Preferred Stock” means the shares of the

Company’s Series A-6 Preferred Stock, par value $0.00001 per share.

“Company Series A-7 Preferred Stock” means the shares of the

Company’s Series A-7 Preferred Stock, par value $0.00001 per share.

7

“Company Series A-8

Preferred Stock” means the shares of the Company’s Series A-8 Preferred Stock, par value $0.00001 per share.

“Company Series A-9 Preferred Stock” means the shares of the

Company’s Series A-9 Preferred Stock, par value $0.00001 per share.

“Company Series A-10 Preferred Stock” means the shares of the

Company’s Series A-10 Preferred Stock, par value $0.00001 per share.

“Company Series A-11 Preferred Stock” means the shares of the

Company’s Series A-11 Preferred Stock, par value $0.00001 per share.

“Company Series X Preferred Stock” means the shares of the Company’s Series X Preferred Stock, par value

$0.00001 per share.

“Company Stock” means, collectively, the Company Common Stock, the Company Founders

Preferred Stock and the Company Preferred Stock.

“Company Stock Adjusted Fully Diluted Shares” means the

sum of (without duplication) (a) the aggregate number of shares of Company Stock outstanding as of immediately prior to the Effective Time (including all shares of Company Restricted Stock, whether vested or unvested) and (b) the aggregate

number of shares of Company Common Stock issuable upon exercise of all (i) Company Stock Options (vested or unvested) and (ii) Company Warrants (vested or unvested), in each case, outstanding as of immediately prior to the Effective Time.

“Company Stock Options” means any option to purchase Company Common Stock pursuant to the Company Stock

Plan.

“Company Stock Plan” means the Company’s 2015 Stock Plan.

“Company Stockholder” means the holder of a share of: (a) Company Common Stock; (b) Company

Preferred Stock; or (c) Company Founders Preferred Stock.

“Company Termination Payment” means

$29,288,286.92.

“Company Tail Termination Payment” means $87,864,860.76.

“Company Warrant Amendments” means that certain (a) Amendment to Stock Purchase Warrant, dated as of the

date hereof, by and between the Company and SQN Venture Income Fund, L.P., a Delaware limited partnership, and (b) Omnibus Amendment to Stock Purchase Warrants, dated as of the date hereof, by and among the Company and the other parties

thereto.

“Company Warrants” means, collectively, the warrants described on

Schedule 1.01(a).

8

“Confidentiality Agreement” means that certain Non-Disclosure Agreement, dated as of June 5, 2020, between Parent and the Company.

“Consent Solicitation Statement” means the consent solicitation statement included as part of the Registration

Statement with respect to the solicitation by the Company of the Company Requisite Approval.

“Contaminant” means any “back door,” “drop dead device,” “time bomb,”

“Trojan horse,” “virus” or “worm” (as such terms are commonly understood in the software industry) or any other code designed or intended to have, or capable of performing or that without user intent will cause, any of

the following functions: (a) disrupting, disabling, harming or otherwise impeding in any manner the operation of, or providing unauthorized access to, any Software, hardware or device (including any computer, tablet computer, handheld device,

disk or storage device); (b) damaging or destroying any data or file without the user’s consent; or (c) sending information to the Company or any of its Subsidiaries, or any other Person, without the user’s consent.

“Continental” means Continental Stock Transfer & Trust Company, a New York corporation.

“Contracts” means any contract, agreement, indenture, note, bond, loan or credit agreement, instrument, lease,

commitment, mortgage, deed of trust, license, power of attorney, guaranty or other arrangement, understanding or obligation, whether written or oral, express or implied, in each case, as amended and supplemented from time to time and including all

schedules, annexes and exhibits thereto.

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions thereof or any other epidemics, pandemics or disease outbreaks.

“COVID-19 Measures” means any quarantine, “shelter in

place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester or any other Law, Governmental Order, Action, directive, guidelines or recommendations by any Governmental Authority in connection with or

in response to COVID-19, including, but not limited to, the CARES Act.

“COVID-19 Quarantine Period” means, with respect to each regular work location of the Company and its Subsidiaries, the period during which the state or local Governmental Authority restricted nonessential

work at such location.

“D&O Indemnified Party” has the meaning specified in

Section 8.01(a).

“D&O Tail” has the meaning specified in

Section 8.01(b).

“DGCL” has the meaning specified in the Recitals hereto.

“Dissenting Shares” has the meaning specified in Section 3.10.

“DLLCA” has the meaning specified in the Recitals hereto.

9

“Earn Out Period” means the time period between the Lockup

Expiration Date and the fifth (5th) year anniversary of the Lockup Expiration Date.

“Earn Out Pro Rata Share” means for each Company Stockholder (including for this purpose each holder of

Company Restricted Stock), a percentage determined by dividing (a) the total number of shares of Company Stock held by such Company Stockholder (including all shares of unvested Company Restricted Stock, and the aggregate number of shares of

Company Stock issuable upon exercise of all Company Warrants (vested or unvested), in each case, held by such Company Stockholder, but excluding any shares of Company Series X Preferred Stock or shares of Company Common Stock issued prior to the

Effective Time upon conversion of such Company Series X Preferred Stock), in each case as of immediately prior to the Effective Time by (b) the total number of shares of Company Stock held by all Company Stockholders (including all shares of

unvested Company Restricted Stock, and the aggregate number of shares of Company Stock issuable upon exercise of all Company Warrants (vested or unvested), in each case, held by all Company Stockholders but excluding any shares of Company Series X

Preferred Stock or shares of Company Common Stock issued upon conversion of such Company Series X Preferred Stock), in each case as of immediately prior to the Effective Time.

“Earn Out Shares” has the meaning specified in Section 4.01(a).

“Effective Time” has the meaning specified in Section 2.01(a).

“Environmental Laws” means any and all applicable Laws relating to pollution or protection of the environment

(including natural resources), worker health and safety as it relates to exposure to Hazardous Materials, or the use, generation, storage, emission, transportation, disposal or release of or exposure to Hazardous Materials.

“ERISA” has the meaning specified in Section 5.14(a).

“ERISA Affiliate” has the meaning specified in Section 5.14(e).

“Exchange Act” means the Securities Exchange Act of 1934.

“Exchange Agent” has the meaning specified in Section 3.04(a).

“Financial Derivative/Hedging Arrangement” means any transaction (including an agreement with respect thereto)

which is a rate swap transaction, basis swap, forward rate transaction, commodity swap, commodity option, equity or equity index swap, equity or equity index option, bond option, interest rate option, foreign exchange transaction, cap transaction,

floor transaction, collar transaction, currency swap transaction, cross-currency rate swap transaction, currency option or any combination of these transactions.

“Financial Statements” has the meaning specified in Section 5.07.

“First Certificate of Merger” has the meaning specified in Section 2.01(a).

10

“First Merger” has the meaning specified in

Section 2.01(a).

“First Merger Sub” has the meaning specified in the preamble

hereto.

“GAAP” means United States generally accepted accounting principles, consistently applied.

“Governmental Authority” means any federal, state, provincial, municipal, local or foreign government,

governmental authority, regulatory or administrative agency, governmental commission, department, board, bureau, agency or instrumentality, arbitrator, court or tribunal.

“Governmental Order” means any ruling, order, judgment, injunction, edict, decree, writ, stipulation,

assessment, determination or award, in each case, entered by or with any Governmental Authority.

“Hazardous

Material” means any material, substance or waste that is listed, regulated, or defined as “hazardous,” “toxic,” or “radioactive,” or as a “pollutant” or “contaminant” (or words of similar

intent or meaning) under applicable Environmental Laws, including petroleum, petroleum by-products, asbestos or asbestos-containing material, polychlorinated biphenyls, flammable or explosive substances, mold,

fungicides or pesticides.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and

the rules and regulations promulgated thereunder.

“Indebtedness” means, with respect to any Person,

without duplication, any obligations (whether or not contingent) consisting of: (a) the outstanding principal amount of and accrued and unpaid interest on, and other payment obligations for, borrowed money, or payment obligations issued or

incurred in substitution or exchange for payment obligations for borrowed money; (b) amounts owing as deferred purchase price for property or services, including “earnout” payments; (c) payment obligations evidenced by any

promissory note, bond, debenture, mortgage or other debt instrument or debt security; (d) contingent reimbursement obligations with respect to letters of credit, bankers’ acceptance or similar facilities (in each case to the extent drawn);

(e) payment obligations of a third party secured by (or for which the holder of such payment obligations has an existing right, contingent or otherwise, to be secured by) any Lien, other than a Permitted Lien, on assets or properties of such

Person, whether or not the obligations secured thereby have been assumed; (f) obligations under leases required to be capitalized under GAAP; (g) obligations under any Financial Derivative/Hedging Arrangement; (h) deferred

compensation; (i) outstanding severance obligations or expenses; (j) guarantees, make-whole agreements, hold harmless agreements or other similar arrangements with respect to any amounts of a type described in clauses (a) through (i)

above; and (k) with respect to each of the foregoing, any unpaid interest, breakage costs, prepayment or redemption penalties or premiums, or other unpaid fees or obligations (including unreimbursed expenses or indemnification obligations for

which a claim has been made); provided, however, that Indebtedness shall not include (i) accounts payable to trade creditors that are not past due and accrued expenses arising in the ordinary course of business consistent with

past practice and (ii) Outstanding Company Expenses.

11

“Insider Letters” has the meaning specified in

Section 8.11.

“Insiders” has the meaning specified in

Section 8.11.

“Intellectual Property” means all worldwide rights, title and

interest in or relating to intellectual property, whether protected, created or arising under the laws of the United States or any other jurisdiction, including rights in: (a) all patents and patent applications, including provisional patent

applications and similar filings and any and all substitutions, divisions, continuations, continuations-in-part, reissues, renewals, extensions, reexaminations, patents

of addition, supplementary protection certificates, utility models, inventors’ certificates, or the like and any foreign equivalents of the foregoing (including certificates of invention and any applications therefor) (collectively,

“Patents”); (b) all trademarks, service marks, brand names, trade dress rights, logos, corporate names, and trade names, and other source or business identifiers and general intangibles of a like nature, together with the goodwill

associated with any of the foregoing, along with all applications, registrations, renewals and extensions thereof (collectively, “Trademarks”); (c) all copyrights, works of authorship, literary works, pictorial and graphic works, in

each case whether or not registered or published, all applications, registrations, reversions, extensions and renewals of any of the foregoing, and all moral rights, however denominated (collectively, “Copyrights”); (d) all Internet

domain names and social media accounts; (e) all trade secrets, know-how, technology, Software, discoveries, improvements, formulae, confidential and proprietary information, technical information,

techniques, inventions, designs, drawings, procedures, processes, models, in each case, whether or not patentable or copyrightable (collectively “Trade Secrets”); and (f) all other intellectual property rights.

“Intended Tax Treatment” has the meaning specified in the Recitals hereto.

“Interim Financial Statements” has the meaning specified in Section 5.07.

“Interim Period” has the meaning specified in Section 7.01.

“Invention Assignment Agreement” has the meaning specified in Section 5.11(d).

“Issuance Proposal” has the meaning specified in Section 9.02(c).

“IT Systems” means all information technology, computers, computer systems, communications systems software,

firmware, hardware, networks, servers, interfaces, platforms, related systems, databases, websites and equipment owned, licensed, leased or otherwise used by or on behalf of the Company or any of its Subsidiaries.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

12

“Law” means any statute, law, constitution, treaty,

principle of common law, resolution, code, ordinance, rule, regulation or Governmental Order, in each case, of any Governmental Authority.

“Leased Real Property” has the meaning specified in Section 5.19(b).

“Letter of Transmittal” has the meaning specified in Section 3.04(a).

“Licensed Intellectual Property” means all Intellectual Property (other than Owned Intellectual Property)

used, practiced, or held for use or practice by the Company or any of its Subsidiaries.

“Lien” means any

mortgage, deed of trust, pledge, hypothecation, easement, right of way, purchase option, right of first refusal, covenant, restriction, security interest, title defect, encroachment or other survey defect, or other lien or encumbrance of any kind,

except for any restrictions arising under any applicable Securities Laws.

“Lockup Agreement” has the

meaning specified in the Recitals hereto.

“Lockup Period Expiration Date” means the expiration of the

Common Stock Lock-up Period provided in the A&R Registration Rights Agreement.

“Management Longer Term Equity Incentive Plan” has the meaning specified in

Section 9.06.

“Management Longer Term Equity Incentive Plan Proposal” has the

meaning specified in Section 9.02(c).

“Material Adverse Effect” means any

event, change, circumstance or development that has a material adverse effect on the assets, business, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole; provided, however, that in no

event would any of the following (or the effect of any of the following), alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “Material Adverse Effect” (except in

the case of clause (i), (ii), (iv) and (vi), in each case, to the extent that such change has a disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other industry participants): (i) any change or

development in applicable Laws or GAAP or any official interpretation thereof, in each case, following the date of this Agreement; (ii) any change or development (including any downturn) in interest rates or general economic, political

(including relating to any federal, state or local election), business, financial, commodity, currency or market conditions generally, including changes in the credit, debt, securities, financial, capital or reinsurance markets (including changes in

interest or exchange rates, prices of any security or market index or commodity or any disruption of such markets); (iii) the announcement or the execution of this Agreement or the pendency or consummation of the Mergers (including the impact

thereof on relationships with customers, suppliers, employees or Governmental Authorities); (iv) any change generally affecting any of the industries or markets in which the Company or its Subsidiaries operate or the economy as a whole;

(v) any earthquake, hurricane, tsunami, tornado, flood, mudslide, wild fire or other natural or man-made disaster, pandemic (including COVID-19), act of

13

God or other force majeure event; (vi) any regional, state, local, national or international political or social conditions (or changes thereof) in countries in which, or in the proximate

geographic region of which, the Company operates, including civil or social unrest, terrorism, acts of war, or sabotage or the engagement by the United States or such other countries in hostilities or the escalation thereof, whether or not pursuant

to the declaration of a national emergency or war, or the occurrence or the escalation of any military or terrorist attack (including any internet or “cyber” attack or hacking) upon the United States or such other country, or any

territories, possessions, or diplomatic or consular offices of the United States or such other countries or upon any United States or such other country military installation, equipment or personnel; (vii) any failure of the Company and its

Subsidiaries, taken as a whole, to meet any projections, forecasts, guidance, estimates, milestones, budgets or financial or operating predictions of revenue earnings, cash flow or cash position (it being understood that the facts giving rise to

such failure may be taken into account in determining whether there has been a Material Adverse Effect); (viii) compliance by the Company with the covenants set forth in Sections 7.01(a) through 7.01(s) or (ix) any matter set

forth on Schedule 5.21 the Company Schedules.

“Material Permits” has the meaning specified in

Section 5.26.

“Multiemployer Plan” has the meaning specified in

Section 5.14(e).

“Nasdaq” has the meaning specified in

Section 6.15.

“Non-Redemption

Requirement” has the meaning specified in Section 8.11.

“Notice

Period” has the meaning specified in Section 7.07(c).

“Offer” has the

meaning specified in the Recitals hereto.

“Open Source Software” means any Software that is subject to or

licensed, provided or distributed under any license meeting the Open Source Definition (as promulgated by the Open Source Initiative as of the date of this Agreement) or the Free Software Definition (as promulgated by the Free Software Foundation as

of the date of this Agreement) or any similar license for “free,” “publicly available” or “open source” Software, including the GNU General Public License, the Lesser GNU General Public License, the Apache License, the

BSD License, Mozilla Public License (MPL), the MIT License or any other license that includes similar terms.

“Outstanding Company Expenses” means all fees, costs and expenses of the Company and its Subsidiaries, in each

case, incurred prior to and through the Closing Date in connection with the negotiation, preparation and execution of this Agreement, the other agreements contemplated hereby and the consummation of the Transactions, including: (a) all bonuses,

change in control payments, retention or similar payments payable in connection with the consummation of the Transactions pursuant to arrangements (whether written or oral) entered into prior to the Closing Date whether payable before (to the extent

unpaid) or as of the Closing Date; (b) all severance payments, retirement payments or similar payments or success fees payable pursuant to arrangements (whether written or oral) entered into prior to the Closing Date in connection with or

anticipation of

14

the consummation of the Transactions whether payable before (to the extent unpaid) or as of the Closing Date (excluding, for the avoidance of doubt, any payments to the extent such payments are

subject to service, termination or other vesting requirements (such as double-trigger arrangements), in each case, following the Closing); (c) all transaction, deal, brokerage, financial advisory or any similar fees payable in connection with or

anticipation of the consummation of the Transactions; and (d) all costs, fees and expenses related to the D&O Tail.

“Outstanding Parent Expenses” means (a) all fees, costs and expenses of Parent incurred prior to and

through the Closing Date in connection with the negotiation, preparation and execution of this Agreement, the other agreements contemplated hereby and the consummation of the Transactions, whether paid or unpaid prior to the Closing, (b) any

Indebtedness of Parent or its Subsidiaries owed to its Affiliates or stockholders and (c) any filing fees required by Governmental Authorities, including with respect to any registrations, declarations and filings required, in connection with

the execution and delivery of this Agreement, the performance of the obligations hereunder and the consummation of the transactions contemplated by this Agreement, including filing fees in connection with filings under the HSR Act.

“Owned Company Software” means all Software owned or purported to be owned by the Company or any of its

Subsidiaries.

“Owned Intellectual Property” means all Intellectual Property owned or purported to be

owned by the Company or any of its Subsidiaries.

“Parent” has the meaning specified in the preamble

hereto.

“Parent A&R Bylaws” has the meaning specified in the Recitals hereto.

“Parent A&R Charter” has the meaning specified in the Recitals hereto.

“Parent Affiliate Agreement” has the meaning specified in Section 6.18.

“Parent and Merger Sub Representations” means the representations and warranties of each of Parent, First