Exhibit 99.1

Project Lambda Materials for Meeting with Ad Hoc Group on November 17,

2025 NOVEMBER 2025 | CONFIDENTIAL CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 Cautionary Note Certain of the confidential information required to be disclosed by Luminar Technologies, Inc. and its direct and indirect subsidiaries (the “Company”) pursuant to the

confidentiality agreements (the “Disclosed Information”) are not statements of historical fact and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Such statements are subject to all of the cautionary statements and limitations set forth on the “Disclaimer” page annexed hereto. Certain of these forward-looking statements can be identified by the use of

forward-looking words such as “may,” “will,” “would,” “could,” “expect,” “intend,” “plan,” “aim,” “estimate,” “target,” “project,” “anticipate,” “believe,” “continue,” “objectives,” “outlook,” “guidance,” or other similar words or expressions

and include statements regarding the Company’s plans, strategies, objectives, targets and projected financial performance. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors, and, as a

result, actual results, performance or achievements could differ materially from future results, performance or achievements expressed in these forward-looking statements. Such statements include, but are not limited to, estimated and projected

financial and operating metrics, estimated and projected non-GAAP financial measures, descriptions of management’s strategy, plans, objectives or intentions and descriptions of assumptions underlying any of the above matters and other

statements that are not historical fact. These forward-looking statements are based on then-current beliefs, intentions, and expectations and are not guarantees or indicative of future performance, nor should any conclusions be drawn or

assumptions be made as to any potential outcome of any potential transaction involving the Company (a “Restructuring”) or other transactions the Company considers. The Disclosed Information was not prepared with a view toward public disclosure

and should not be relied upon to make an investment decision with respect to the Company or its indebtedness. The inclusion of the Disclosed Information should not be regarded as an indication that the Company or its affiliates or

representatives consider the Disclosed Information to be a reliable prediction of future events, and the Disclosed Information should not be relied upon as such. Neither the Company nor any of its affiliates or representatives has made or makes

any representation to any person regarding the likelihood or the ultimate outcome of any potential Restructuring, and none of them undertakes any obligation to update the Disclosed Information to reflect circumstances existing after the date of

the Disclosed Information or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the Disclosed Information are shown to be in error.

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 Disclaimer The materials attached hereto (the “Materials”) were prepared by the Company, its representatives, and its advisors (the Company’s representatives and advisors

collectively, the “Advisors”), solely for discussion purposes. The Materials were not prepared with any party’s specific interests in mind. Consequently, (a) there may be matters which may be material to a party which are not addressed by the

Materials, (b) as to matters that are addressed by the Materials, the depth of review, the materials and information reviewed and relied upon, the resources devoted to preparing the Materials, and other determinations affecting the scope,

depth, or details of the Materials may not match any specific party’s needs or expectations, and (c) the Company or its Advisors may have discussed and may continue to discuss orally certain matters with other parties which may not be included

or reflected in the Materials. Therefore, the Materials should not be expected to have considered issues or information related to any or all matters which may be relevant to any specific party or, with respect to the matters actually

considered, that such matters were considered with a scope, or level of depth, detail, or specificity appropriate for any specific party. The Materials are “as is” and based, in part, on information obtained from other sources. The Advisors’

use of such information does not imply that the Advisors have independently verified or necessarily agree with any of such information. None of the Company, its Advisors, or any of their respective affiliates or agents, make any representation

or warranty, express or implied, in relation to the accuracy or completeness of the information contained in the Materials (including, without limitation, any assumptions, data points, and other information set forth in the Materials) or any

data it generates, and expressly disclaim any and all liability (whether direct or indirect, in contract, tort, or otherwise) in relation to any of such information or any errors or omissions therein. Any views or terms contained therein are

preliminary and are based on financial, economic, market, and other conditions prevailing as of the date of the Materials and are subject to change. Neither the Company nor its Advisors undertake any obligations or responsibility to update,

correct, or modify any of the information contained in the Materials. Past performance does not guarantee or predict future performance. Events may occur after the date of the Materials, which could change their content had they been known when

the Materials were prepared. None of the Company or any of its Advisors makes any representation or warranty of any kind regarding the Materials to any party, including, without limitation, as to the accuracy, fairness, reasonableness, or

completeness of the Materials, or to their sufficiency or suitability for any particular purpose. The Materials were provided to certain of the Company’s creditors for their convenience and to facilitate their own review, and not to induce

such parties to participate in any transaction, to make any investment, or for any other purpose. The Materials should not be relied upon or used to form the definitive basis for any decision or action whatsoever, with respect to any proposed

transaction or otherwise. All parties must conduct their own review and may not rely in any manner on the Materials for any purpose whatsoever (including, without limitation, any determination whether or not to (x) participate in any

transaction or investment or (y) take any other action). Any use of the Materials is made entirely at the risk of the recipient thereof. No reliance should be placed on the Materials. The Materials speak as of the date on which they were made.

Neither the delivery of the Materials nor any future discussions with the Company or any of its Advisors shall create an implication that there has been a change in the Company’s posture since such date. The Company and its Advisors undertake

no duty to update the Materials. The Materials may contain certain forward-looking statements, including financial projections, and are subject to all of the cautionary statements as set forth in the “Cautionary Note.” Such forward-looking

statements reflect various assumptions, which assumptions are inherently subject to significant contingencies and uncertainties and may or may not prove to be correct. No forward-looking statement should be regarded as a representation by the

Company or any of its Advisors that any estimate, forecast or projection will be achieved. Nothing contained within the Materials is or should be relied upon as a promise or representation as to future performance or results. Actual results may

vary and those variations may be material and adverse.

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 Table of Contents 5 LiDARCo Business Plan Summary 8 LSI Business Plan Summary

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE LiDARCo Business Plan Summary 10

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

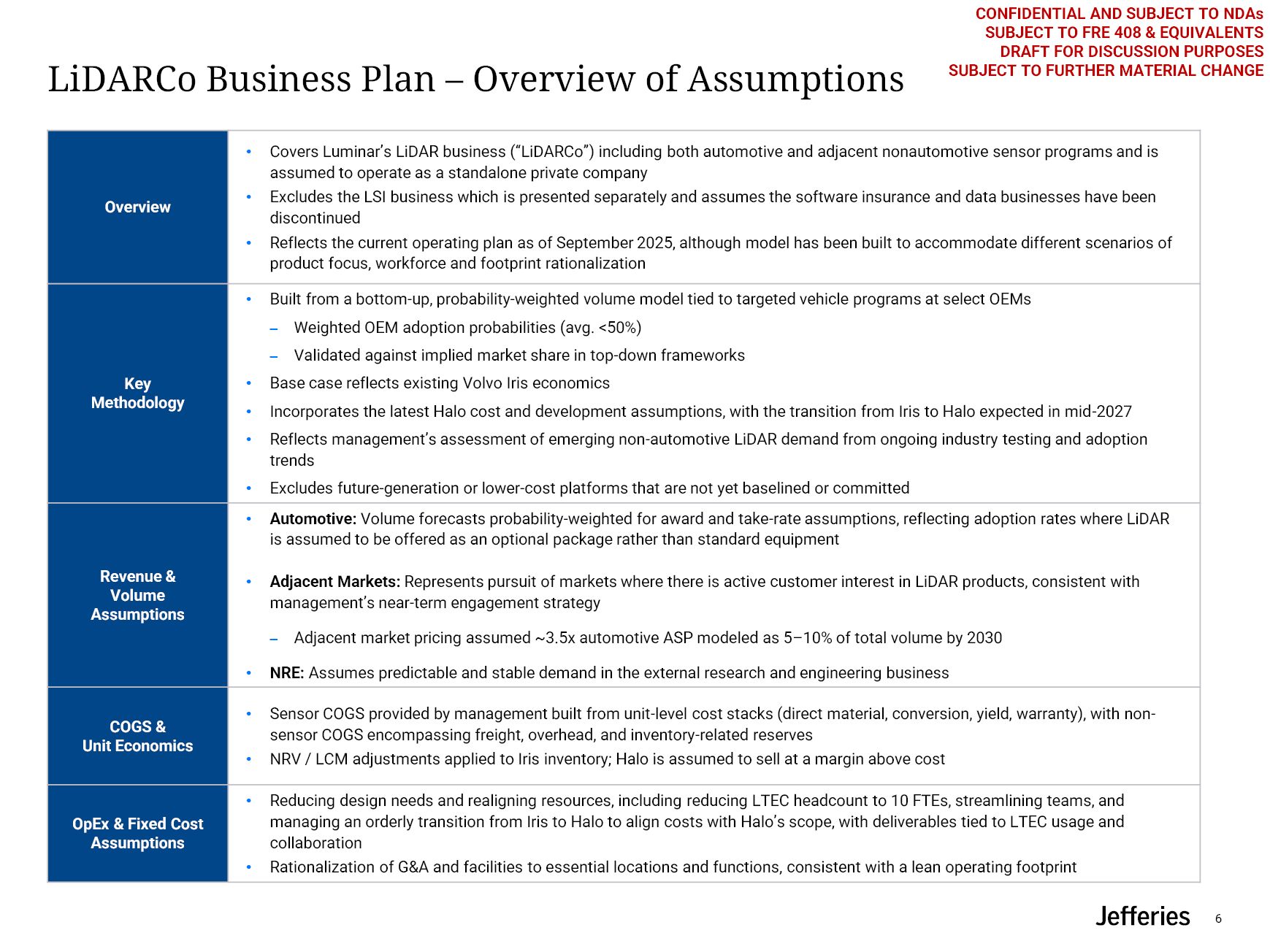

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 LiDARCo Business Plan – Overview of Assumptions Overview Covers Luminar’s LiDAR business (“LiDARCo”) including both automotive and adjacent nonautomotive sensor programs and

is assumed to operate as a standalone private company Excludes the LSI business which is presented separately and assumes the software insurance and data businesses have been discontinued Reflects the current operating plan as of September

2025, although model has been built to accommodate different scenarios of product focus, workforce and footprint rationalization Key Methodology Built from a bottom-up, probability-weighted volume model tied to targeted vehicle programs at

select OEMs ‒ Weighted OEM adoption probabilities (avg. <50%) ‒ Validated against implied market share in top-down frameworks Base case reflects existing Volvo Iris economics Incorporates the latest Halo cost and development assumptions,

with the transition from Iris to Halo expected in mid-2027 Reflects management’s assessment of emerging non-automotive LiDAR demand from ongoing industry testing and adoption trends Excludes future-generation or lower-cost platforms that are

not yet baselined or committed Revenue & Volume Assumptions Automotive: Volume forecasts probability-weighted for award and take-rate assumptions, reflecting adoption rates where LiDAR is assumed to be offered as an optional package

rather than standard equipment Adjacent Markets: Represents pursuit of markets where there is active customer interest in LiDAR products, consistent with management’s near-term engagement strategy ‒ Adjacent market pricing assumed ~3.5x

automotive ASP modeled as 5–10% of total volume by 2030 NRE: Assumes predictable and stable demand in the external research and engineering business COGS & Unit Economics Sensor COGS provided by management built from unit-level cost

stacks (direct material, conversion, yield, warranty), with non- sensor COGS encompassing freight, overhead, and inventory-related reserves NRV / LCM adjustments applied to Iris inventory; Halo is assumed to sell at a margin above cost OpEx

& Fixed Cost Assumptions Reducing design needs and realigning resources, including reducing LTEC headcount to 10 FTEs, streamlining teams, and managing an orderly transition from Iris to Halo to align costs with Halo’s scope, with

deliverables tied to LTEC usage and collaboration Rationalization of G&A and facilities to essential locations and functions, consistent with a lean operating footprint

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

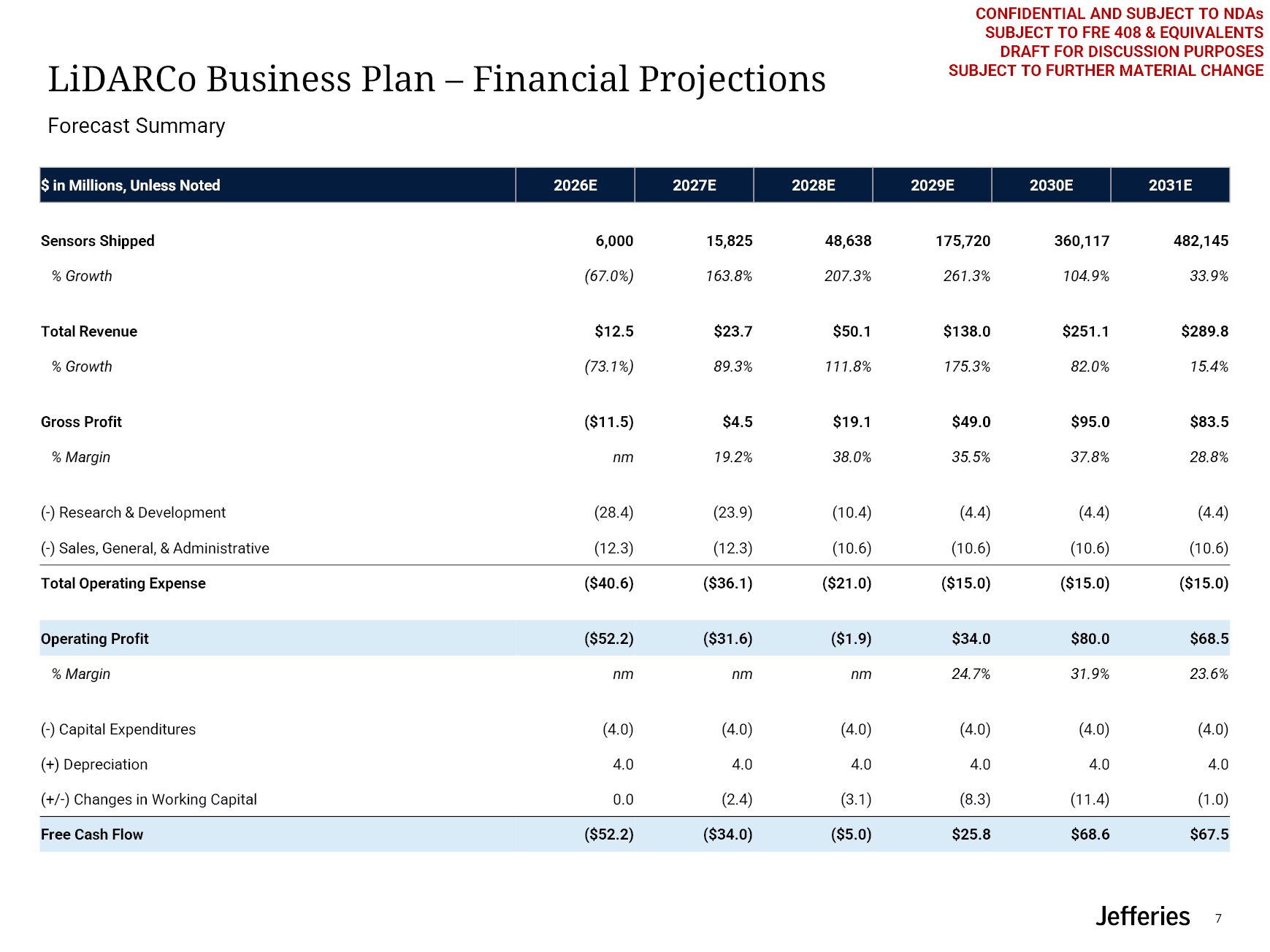

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 LiDARCo Business Plan – Financial Projections Forecast Summary $ in Millions, Unless Noted 2026E 2027E 2028E 2029E 2030E 2031E Sensors

Shipped 6,000 15,825 48,638 175,720 360,117 482,145 % Growth (67.0%) 163.8% 207.3% 261.3% 104.9% 33.9% Total Revenue $12.5 $23.7 $50.1 $138.0 $251.1 $289.8 % Growth (73.1%) 89.3% 111.8% 175.3% 82.0% 15.4% Gross

Profit ($11.5) $4.5 $19.1 $49.0 $95.0 $83.5 % Margin nm 19.2% 38.0% 35.5% 37.8% 28.8% (-) Research & Development (28.4) (23.9) (10.4) (4.4) (4.4) (4.4) (-) Sales, General, &

Administrative (12.3) (12.3) (10.6) (10.6) (10.6) (10.6) Total Operating Expense ($40.6) ($36.1) ($21.0) ($15.0) ($15.0) ($15.0) Operating Profit ($52.2) ($31.6) ($1.9) $34.0 $80.0 $68.5 %

Margin nm nm nm 24.7% 31.9% 23.6% (-) Capital Expenditures (4.0) (4.0) (4.0) (4.0) (4.0) (4.0) (+) Depreciation 4.0 4.0 4.0 4.0 4.0 4.0 (+/-) Changes in Working Capital 0.0 (2.4) (3.1) (8.3) (11.4) (1.0) Free Cash

Flow ($52.2) ($34.0) ($5.0) $25.8 $68.6 $67.5

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE LSI Business Plan Summary 10

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

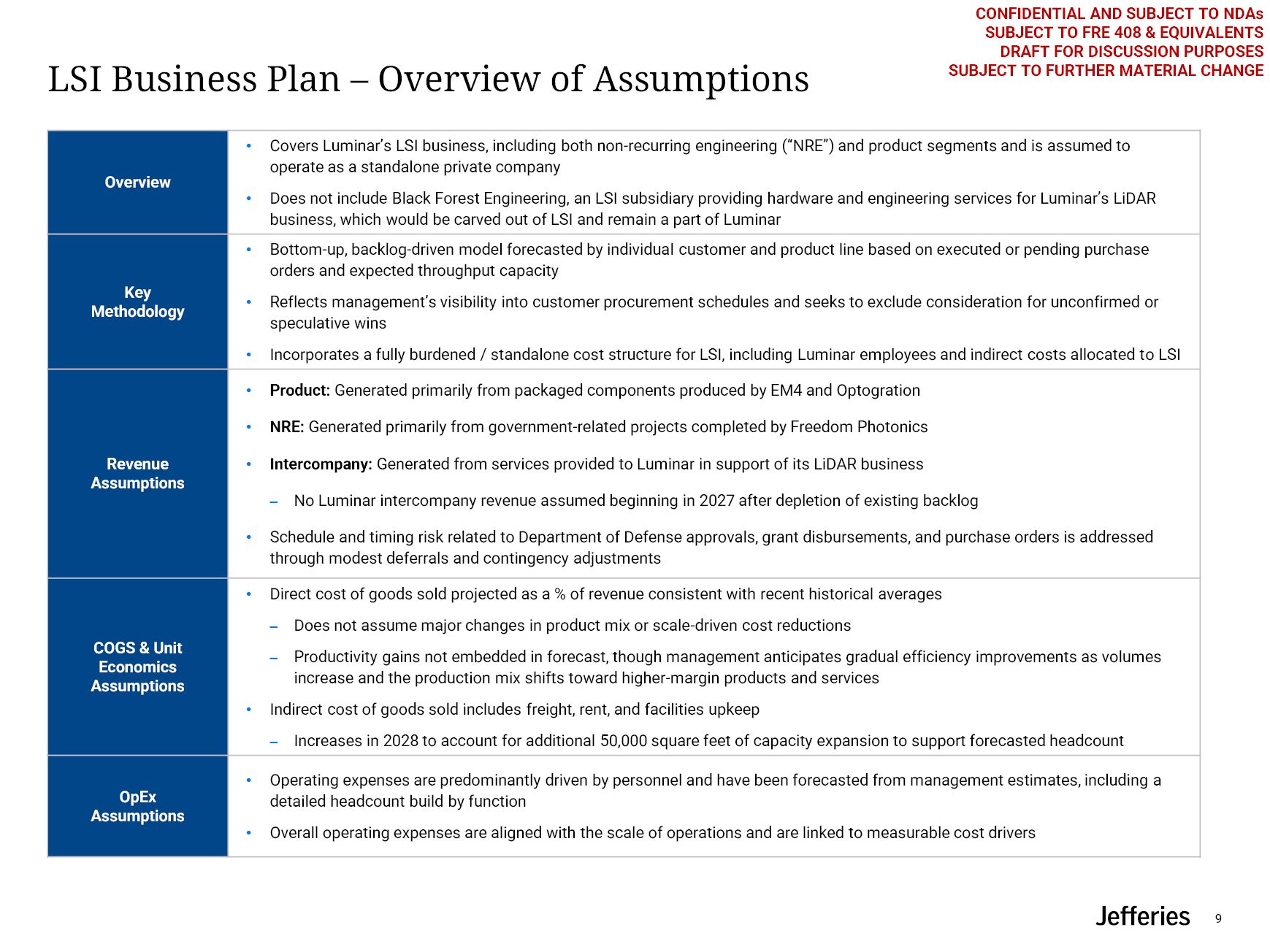

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 LSI Business Plan – Overview of Assumptions Overview Covers Luminar’s LSI business, including both non-recurring engineering (“NRE”) and product segments and is assumed to operate

as a standalone private company Does not include Black Forest Engineering, an LSI subsidiary providing hardware and engineering services for Luminar’s LiDAR business, which would be carved out of LSI and remain a part of Luminar Key

Methodology Bottom-up, backlog-driven model forecasted by individual customer and product line based on executed or pending purchase orders and expected throughput capacity Reflects management’s visibility into customer procurement schedules

and seeks to exclude consideration for unconfirmed or speculative wins Incorporates a fully burdened / standalone cost structure for LSI, including Luminar employees and indirect costs allocated to LSI Revenue Assumptions Product: Generated

primarily from packaged components produced by EM4 and Optogration NRE: Generated primarily from government-related projects completed by Freedom Photonics Intercompany: Generated from services provided to Luminar in support of its LiDAR

business ‒ No Luminar intercompany revenue assumed beginning in 2027 after depletion of existing backlog Schedule and timing risk related to Department of Defense approvals, grant disbursements, and purchase orders is addressed through modest

deferrals and contingency adjustments COGS & Unit Economics Assumptions Direct cost of goods sold projected as a % of revenue consistent with recent historical averages ‒ Does not assume major changes in product mix or scale-driven cost

reductions ‒ Productivity gains not embedded in forecast, though management anticipates gradual efficiency improvements as volumes increase and the production mix shifts toward higher-margin products and services Indirect cost of goods sold

includes freight, rent, and facilities upkeep ‒ Increases in 2028 to account for additional 50,000 square feet of capacity expansion to support forecasted headcount OpEx Assumptions Operating expenses are predominantly driven by personnel

and have been forecasted from management estimates, including a detailed headcount build by function Overall operating expenses are aligned with the scale of operations and are linked to measurable cost drivers

CONFIDENTIAL AND SUBJECT TO NDAs SUBJECT TO FRE 408 & EQUIVALENTS DRAFT FOR

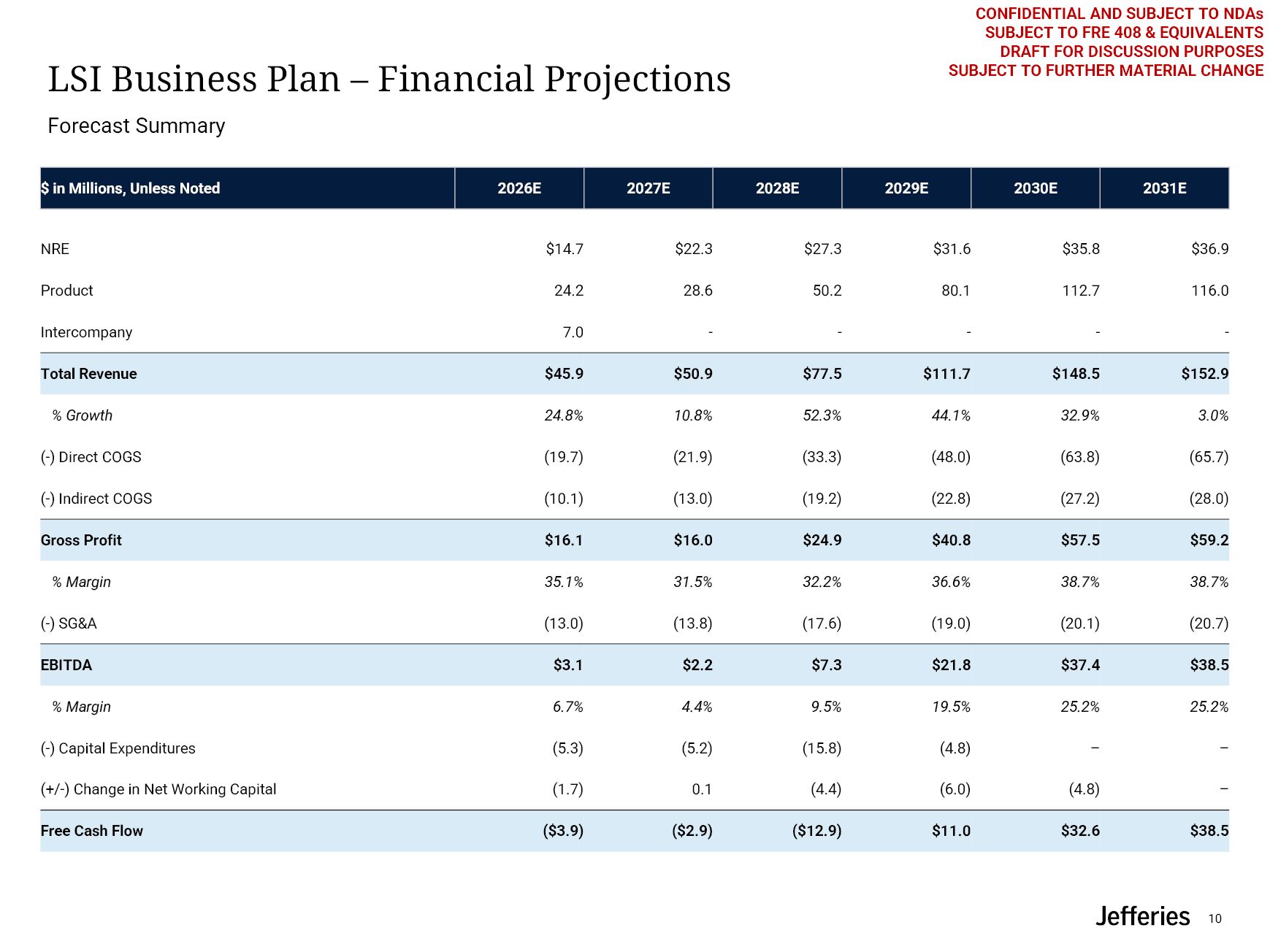

DISCUSSION PURPOSES SUBJECT TO FURTHER MATERIAL CHANGE 10 LSI Business Plan – Financial Projections Forecast Summary $ in Millions, Unless

Noted 2026E 2027E 2028E 2029E 2030E 2031E NRE $14.7 $22.3 $27.3 $31.6 $35.8 $36.9 Product 24.2 28.6 50.2 80.1 112.7 116.0 Intercompany 7.0 - - - - - Total Revenue $45.9 $50.9 $77.5 $111.7 $148.5 $152.9 %

Growth 24.8% 10.8% 52.3% 44.1% 32.9% 3.0% (-) Direct COGS (19.7) (21.9) (33.3) (48.0) (63.8) (65.7) (-) Indirect COGS (10.1) (13.0) (19.2) (22.8) (27.2) (28.0) Gross Profit $16.1 $16.0 $24.9 $40.8 $57.5 $59.2 %

Margin 35.1% 31.5% 32.2% 36.6% 38.7% 38.7% (-) SG&A (13.0) (13.8) (17.6) (19.0) (20.1) (20.7) EBITDA $3.1 $2.2 $7.3 $21.8 $37.4 $38.5 % Margin 6.7% 4.4% 9.5% 19.5% 25.2% 25.2% (-) Capital

Expenditures (5.3) (5.2) (15.8) (4.8) – – (+/-) Change in Net Working Capital (1.7) 0.1 (4.4) (6.0) (4.8) – Free Cash Flow ($3.9) ($2.9) ($12.9) $11.0 $32.6 $38.5